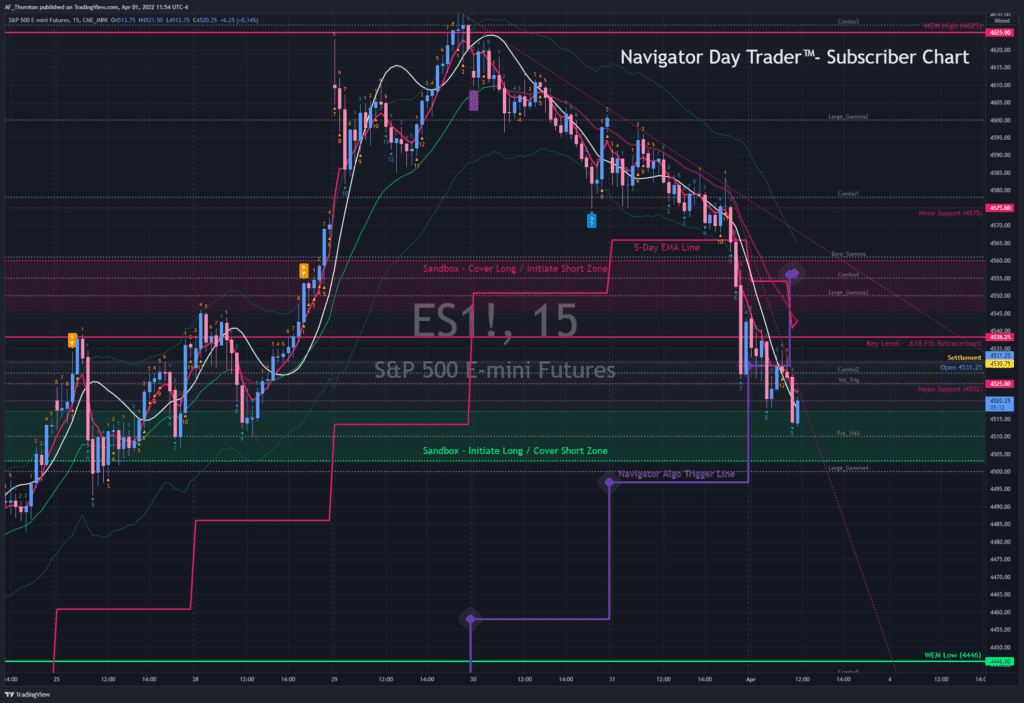

So here is the image of the market from this morning when I alerted you that we were coming into a turn. All of the colors and levels went to our Navigator Day Trader subscribers pre-market,

Alert Chart from Last Post

Alert Chart from Last Post

We initiated the trade at the bottom of the green zone. There is a Tick, VIX, and Momentum divergence on the low, alerting us to the coming pivot.

Here comes the turn – right off the bottom of the green zone.

Here comes the turn – right off the bottom of the green zone.

We take the profit as we come back up to the Volatility Trigger. The profit is about $825 per contract after spreads and costs. Your profits depend on how many contracts you did. Even on a micro, it is $82.50 per contract.

Here is where I took my profit.

Here is where I took my profit.

I don’t really know or care what the market does from here. I would theorize that the support of the Volatility Trigger and 5-day EMA are now resistant. So we made the easy money; why worry about another trade on a Friday afternoon?

So now you see how this works for Navigator Day Trader subscribers. They paid for their monthly subscription two times over in a single session on one contract. And we mapped the entire day out for them ahead of time.

You can learn more about our subscriptions here.

A.F. Thornton