MAGA Remains The Greatest Threat to Free Speech

Good Morning:

- Tounge in cheek, the Babylon Bee is reporting that Apple is waiting for permission from China to ban Twitter from the Apple store. The reporting seemed so apropo these days – I almost believed it.

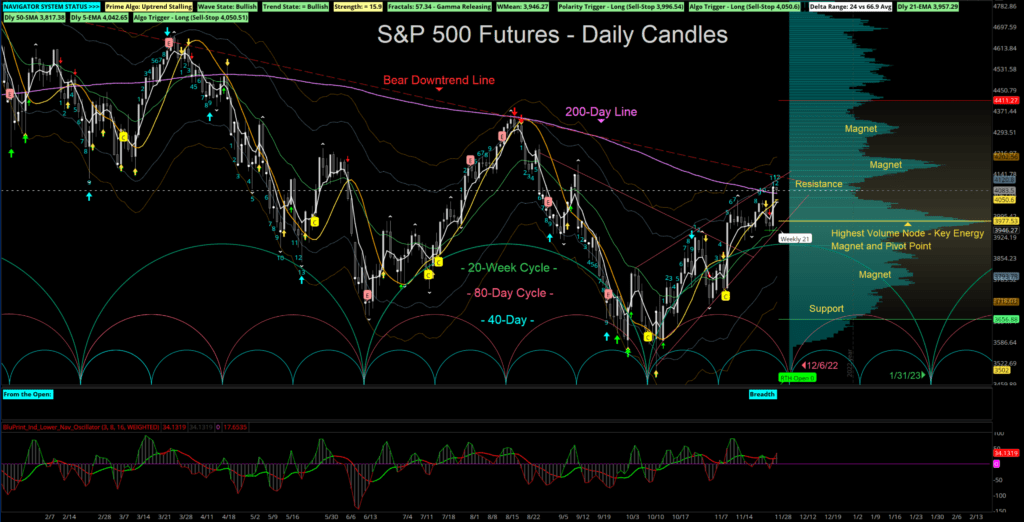

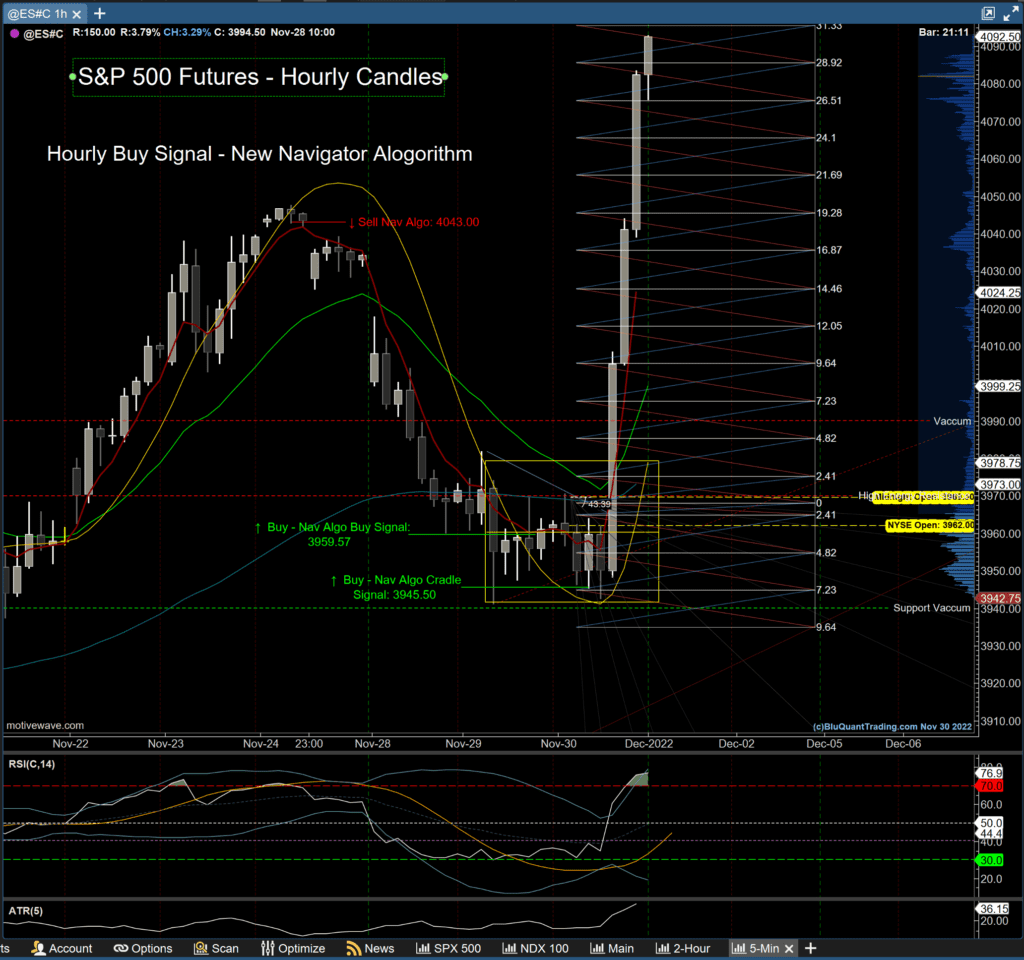

- Futures are up slightly to 3958 from overnight lows of 3916 – a somewhat positive turn after the weekly unemployment claims came out in line with expectations this morning.

- 3950-3960 (SPY 395) remains the first resistance, with 4000 the next stumbling block.

- Bottom Line Support is at 3900. But the WEM Low is also Cushioning the Market at 3930. Our volatility estimates remain near a Somewhat benign 1% today.

- Traders have built up this “balance range” of positioning from 3900 -4000, which implies this zone should be sticky into Friday.

- We will be in the Trading Room tomorrow instead of today, as we want to take advantage of the CPI Report Release. Also, we are continuing the Room Upgrades today, allowing us to record future day sessions. So charts will not be up until late morning.

- For now, the balance area/channel lows near 3950 are the battle lines at hand. The dip into mid-month still seems the most likely course.

- And, yes, I am watching the Twitter saga, and I will have more to say about that soon.

- Twitter’s shift to fairness is encouraging, but the 2020 Marxist Coup/Takeover of the United States of America seems all but complete. All that remains is the Trumpification of Elon Musk if they don’t outright assassinate him.

- My Prayers are with Mr. Musk.

A.F. Thornton