Morning Notes – 4/12/2022

Good Morning:

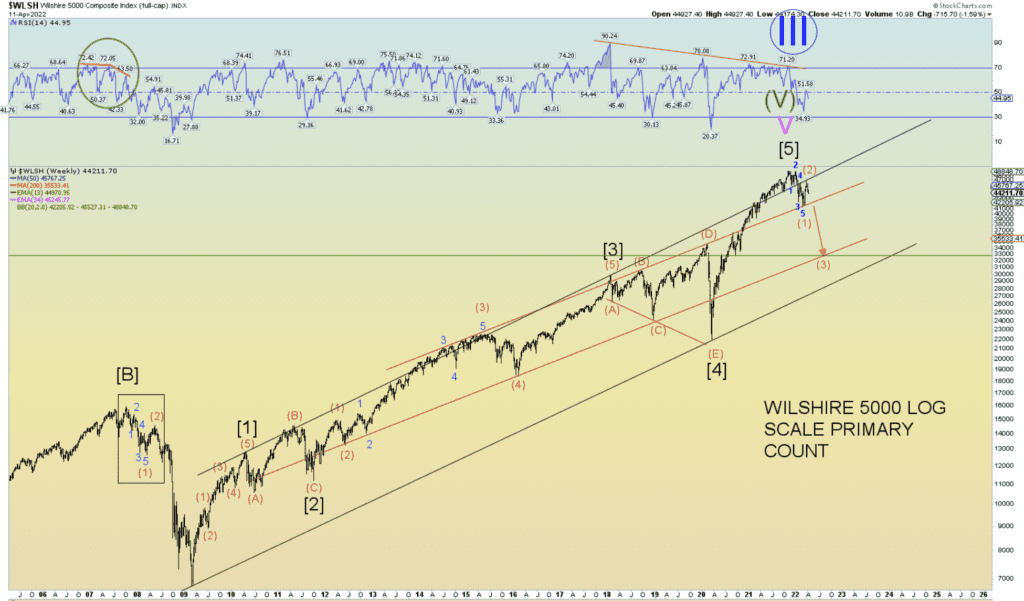

- At the moment, the simplicity of analyzing the broad market in the chart above, courtesy of Daneric Elliott Waves, cannot be understated.

- Daneric makes the following excellent points, and I agree:

This Wilshire 5000 Index weekly chart shows a solid five waves down and three waves corrective “up.” And prices rejected at a simple neckline of a simple head and shoulders broken pattern that had met its initial downside target.

The market has a simple count, a simple look, and simple technicals; why try and out-think things at this stage?

Even the simple technicals of a positive diverging RSI at the wave (1) low on a daily chart suggested prices would peak above the point of initial divergence (wave 4 of (1) down).

And thus, it was fulfilled, but that fulfillment is over. There are no more bullish technicals to “scream” higher prices are coming.

We made that case at the (1) low, and the price fulfilled those technicals in the rally that ensued. There is nothing technically or even sentiment-wise suggesting buying the overpriced market at this stage.

I won’t say rallying up to new highs won’t happen. For sure, we have seen how the madness of crowds can linger on seemingly forever.

- While most of you know that I am not a big Elliott Wave fan because the waves are subject to so much interpretation in real-time, sometimes the strategy can be helpful when the count is clear. This may be one of those times.

- An alternate count could accommodate one more small bounce to get us through Easter.

- But if the overall wave (2) is complete, as suggested in the chart above, then wave (3) lower, and all its ugly, nasty subwaves may be in store for the market.

- And that is the true danger of betting on bear market “bounces.”

- And bounce we should, as we closed yesterday near the WEM low at 4400.

- But we are now in negative Gamma territory, with higher volatility, and we are midstream in at least one Head and Shoulders Top pattern that projects lower prices.

- We will see how well the options market has priced the week ahead if it respects the WEM. Nobody wants Good Friday to turn into Black Friday, so one might hope that the WEM low at 4400 holds for the rest of the week.

- As reliable as the WEM framework is each week (the probability is about 70% that the boundaries will contain the price action), don’t dismiss the other 30% of the time when the boundaries fail.

- If the WEM low doesn’t hold, you will witness what it looks like when you are coming down from the nosebleed seats in a Primary (3) wave down.

- The two leading indicators we have been following closely, Junk Bonds (JNK) and Transports (IYT), are now trading below their March lows, and the S&P 500 is likely to follow.

- What buying there is has been concentrated on defensive names. Investors have been dumping tech and other growth stocks.

- Recall from the Morning Notes that the market is not hedged like it was in March, and there is a notable air pocket between current levels and the March lows.

- Anything is possible when you tag the WEM low on a Monday. Price even sliced through the 50-day line today like it wasn’t there.

- Air pockets are the wake left after a rip-your-face-off short-covering rally one-time frames higher end over end and does not spend much time or experience volume at price.

- Bank earnings are also on deck this week, starting with JP Morgan Chase on Wednesday and more banks on Thursday. Forward guidance will be critical.

- I am asking myself, what will change this downward trajectory?

- Support today lies at 4420, then 4400, with the next significant support down and through the air pocket to 4310. Look for resistance at 4450, then 4475.

- With call buyers absent recently and put buyers finally showing up yesterday, volatility is rising, as it usually does in put-dominated markets.

- The Expected Move today is plus or minus 56 points from the Open.

- The March Consumer Price Index print came in a fraction higher than consensus at 8.5%. Don’t you love “transitory” inflation?

- At this writing, the futures market is taking the CPI news positively, nipping overnight losses that reached down to 4382.

- Dealers undoubtedly breathed a sigh of relief with the rally, as it negates their need to defend the 4400 WEM low.

- So why the rally? Don’t forget that the White House tried to get ahead of the CPI report yesterday by preparing us for an alarming number. Perhaps the market took the brunt of the loss yesterday.

- There could also be short-covering by traders who bet on an even higher number above consensus.

- And, there is the WEM low where we should expect a bounce anyway.

- These are complicated waters to navigate.

- Always remember that returns are ultimately about flows – not narratives.

- Until the market recovers the Volatility Trigger ( now 4475), put flows and high volatility will drive prices.

- Subscriber Morning charts are up.

A.F. Thornton

Share with Friends and Family

Word of mouth is crucial for growing our trading community and providing education and support for your trading decisions. Please feel free to share this with your friends and family if you find the information beneficial.

Related Posts