Founder’s Trading Journal

Navigator Swing Strategy™

- Current Position: 100% Cash / Short

- Buy Stop: 4014.25

- Last Signal: Sell on 8/15/2022 @4302.75 - Closes Buy from 7/18/2022 @3832.25

- S&P 500 Index from Signal: -392.75 Points / -10.95% ***

Navigator Algorithm™ Trends

- Hourly: Bearish

- Daily: Bearish

- Weekly: Bearish

- Monthly: Bearish

Navigator Trading Sandboxes™

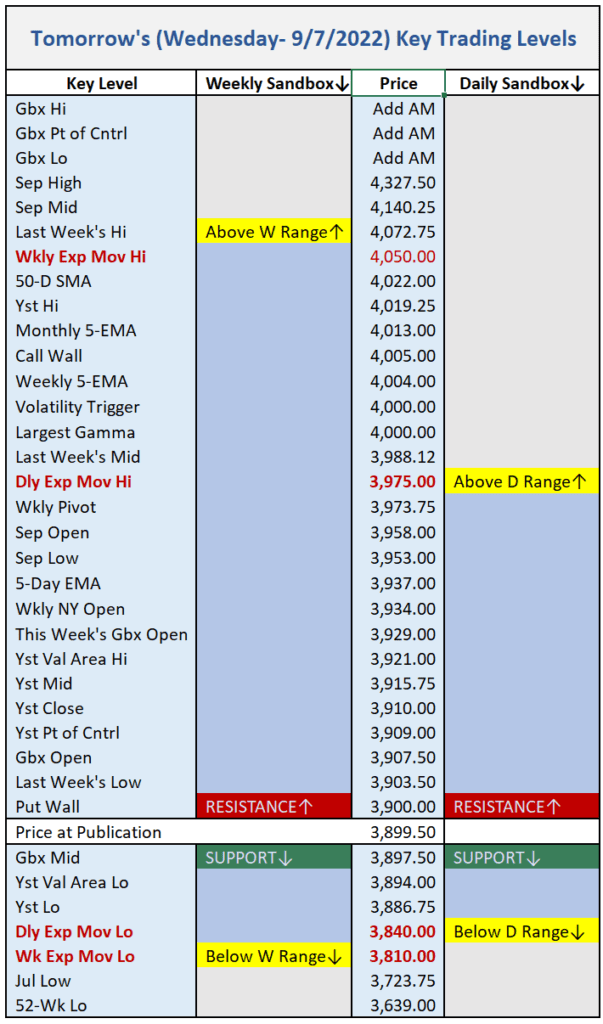

The daily and weekly trading sandboxes form our windshields for daily and weekly trading. We derive the sandbox boundaries from the Chicago Board Options Exchange. The exchange uses the Black-Scholes option pricing model to set the edges.

There is a 68% statistical probability that prices will close inside the Daily Sandbox for that day (Daily Expected Move or DEM) and Weekly Sandbox for that week (Weekly Expected Move or WEM).

With the daily and weekly range identified in advance, traders can focus on the important support and resistance clusters that will present inside the boundaries, rather than the kitchen sink of levels and indicators. The predictability makes it easier to plan “if this – then that, if not – then what” scenarios in advance.

Working the boundaries can be tricky. The probabilities and boundaries are calcualted as of expiration (which occurs at the daily or weekly NYSE close). That leaves some tolerance for the expected moves to temporarily post outside the range boundaries prior to expiration.

However, suppose the price moves substantially beyond the upper or lower boundary – perhaps more than 50 to 75 points? In that case, dealer counterparties must buy or sell futures in the same direction as the boundary violation to hedge their inventory. Otherwise, they stand to lose billions.

This protective reaction is counterintuitive, as it makes the boundary violation worse,and can accelerate the outside move up to two standard deviations (double the range). Fortunately, this happens only one-third of the time.

Knowing the boundaries gives traders an edge for several reasons. First, it allows traders to focus on the key isssues they are likely to encounter inside the boundaries for the trading day and week. The trader maintains awareness of the important levels just outside the ranges, but does not expect to encounter them often.

Second, the boundary levels themselves can act as important support, resistance, and reversal points during the day and week. Also, when the price exceeds the boundaries, traders can fade the price with the dealers back into range as the options approach expiration. Dealers and market makers are considered the smart money. Trading with them is akin to trading with the the “house.”

Founder's Journal and Trading Notes

Below are a few relevant excerpts for today from A.F. Thornton’s personal trading journal and notes. Check out the full notes with a Subscription, which includes access to Mr. Thornton’s live charts in the Founders Trading Room. The full journal contains Mr. Thornton’s daily trading plan and reflections on his daily gains and losses.

Be forewarned that the notes can sometimes be offensively blunt and politically incorrect, as Mr. Thornton occasionally vents about geopolitical and economic issues influencing financial markets.

References to “the Market” in the journal and Blog refer to the S&P 500 Index. The quoted numbers are from the front month E-Mini continuous futures contract. BluPrint’s primary business focus is applying its proprietary Navigator Algorithms™ to the S&P 500 index using the cash SPY ETF, options on the SPX or SPY, and S&P 500 EMini and micro futures as the investment vehicles.

The Navigator Algorithms™ dictate the buy and sell signals for BluPrint’s Navigator swing strategy. But Mr. Thornton also applies the algorithms to day trade intraday charts down to 2-minute candles. His live, intraday charts are available throughout the day in the Founders Trading Room with a Subscription,

The algorithms also show whether the S&P 500 is in an uptrend or downtrend. The direction of the index has a considerable influence on the path of individual stocks. The Navigator Algorithms™ can serve as an initial screen to help determine whether you have the wind at your back in stock trading.

- Considering the negative energy news out of Europe over the weekend, the markets held up remarkably well today. I am suspicious that there might have been some Fed assistance – but who ever really knows (other than them)?

- The 3900 Put Wall was the inflection point where the market danced most of the day after the opening rally and immediate sell-off, a typical pattern of late. I am suspicious that 3900 could morph into resistance if the price finds acceptance below. We shall see what the next few days bring.

- The market is working its way lower, and my target would be 3865 or so before we get a significant flip.

- Keep in mind that I am never married to any working theory. I go will always go with the flow.

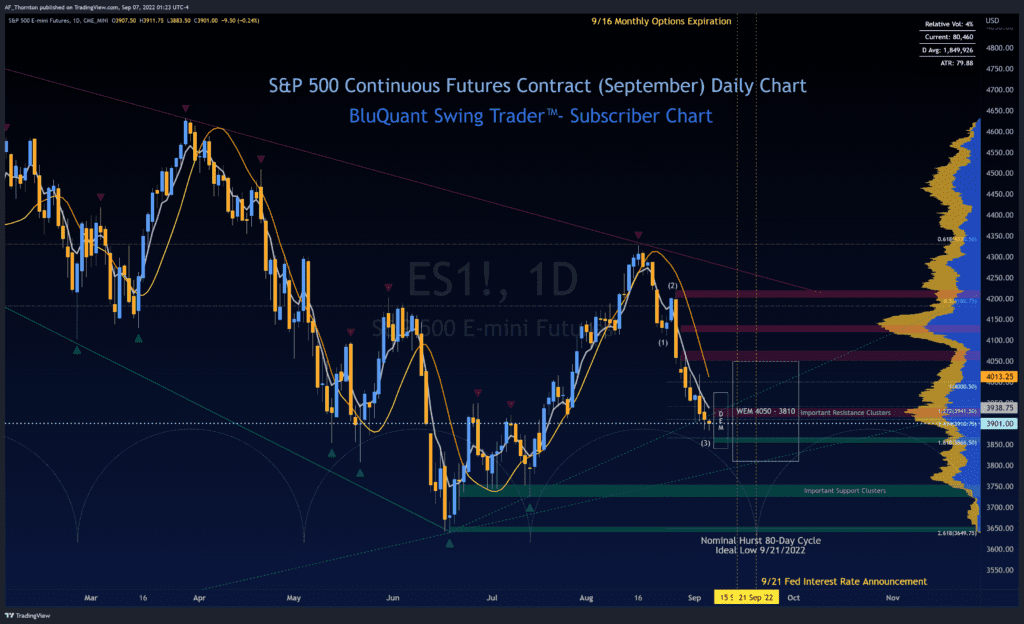

- I listed all key support and resistance in the table above. I also marked the important clusters on the first chart. The levels help you know where to anticipate a pause or turn, but there is no substitute for monitoring the auction level by level to see where the price wants to stick or reverse.

- Watch the 5-EMA on the daily chart – traders are still shorting off the level. Closing above the level could be bullish. Also, keep an eye on the CBOE equity put/call ratio. It rose into the high end of the range today and creates the risk of a rip-your-face-off short-covering rally or meaningful reversal point. The sentiment is about as negative as I have seen, presenting a contrarian’s paradise. That is unless the crowd is right…

- And we are reminded that the market is in its third wave down, arguably the cruelest leg of any bear market. But you can expect the market to tease and wear you out before delivering the negative goods.

- Tomorrow (Wednesday) will be tricky. There is a cadre of Fed Governors hitting the speaking circuit. The first question is why? What expectations will they attempt to manage? Will they try to offset the European contagion with a more doveish tone?

- Regardless, the speakers are sure to cause some volatility, which is likely why the options market has priced in a 130-point expected move range for the day. I don’t typically day-trade until after the Fed Govs hit the speaking circuit.

- The 30-Year U.S. Treasury rate closed at a new high yesterday, and the 10-year rate is close to a new high. My best guess is that new highs in the 10-year rate eventually mean new lows in the stock market – below the June low at 3639. But close only counts in horseshoes and hand grenades.

- I am still looking at an ultimate bear market target of 3000 before year-end, give or take a few hundred points. And, after all, what are a few hundred points among friends?

- Don’t forget that all key levels reverse polarity when materially breached. Support becomes resistance and vice versa. The table above shows where the S&P Futures traded when I published today’s Blog. Move the support and resistance labels as appropriate after the NYSE opens. Anything above the Open is resistance, and below is support.

- The parabolic U.S. Dollar, which threatens to take down all the emerging, debt-ridden, global economies, is finishing a rising wedge pattern on the daily chart. The pattern telegraphs a decline coming soon – some welcome relief for the third world debtors. By the way, shouldn’t the debt-ridden “third world” now include the United States Banana Republic of America?

- A falling dollar is usually good for stocks – but the parabolic dollar uptrend must reverse.

- Traders continue to add protection, moving the Put Wall, Zero Gamma, and Volatility Trigger lower.

- Negative Gamma pressure persists – count on more. Dealers will continue to hedge their inventory by selling futures into declines, worsening the down thrusts. But this effect also works in reverse. Dealers must buy futures into rallies, making them stronger and last longer. We call this behavior Gamma squeezes or spirals.

- Heavy volume continues, and the daily chart candles have one-time framed lower for quite a few days in a row. Continue to watch how much volume is moving price. Stalling (high volume with very little price movement) often precedes important lows.

- Don’t forget that the Hurst Nominal 80-day cycle is due to trough soon and could give us a left translation bounce – perhaps from the 1.618 Fib target (approximately 3866). The “perfect” cycle low date coincides with the 9/21 Fed Announcement.

- Very serious global tensions continue to mount now that Russia has formally weaponized energy. The Germans are no longer laughing at President Trump’s Russian energy dependence warning, are they?

- As mentioned before, we are experiencing a moment in time that requires us to prepare for the worst. It would help if you had a contingency plan for yourself and your extended family.

- It is always advisable to have such a plan, with extra food and water on hand. But perhaps it is more important now than ever before.

- I plan to be as self-sufficient as possible if there is a need to ride out the economic and political storm.

- But my plan is all about keeping my trading screens running. How could I possibly live without trading? I can last a few days without food and water – but my screens?

- I will be the guy who shorts the crash and doesn’t get paid because the brokerage firm goes bankrupt.

A.F. Thornton

*** At today’s close, those who chose to short the last Navigator Swing Strategy™ sell signal on 8/15/2022 at 4302.75 have gained profits of $19,637.50 per Emini futures contract (456.39%) and $3133.00 per SPY put option contract (324.66%). Final results will vary depending on the ultimate exit price of the position at the next Navigator Swing Strategy™ buy signal.

Futures and options are leveraged instruments that involve high risk, volatility, leverage, and loss. With leveraged futures, you could lose more than your original investment. Past performance does not guarantee you can achieve similar results.

Share with Friends and Family

Word of mouth is crucial for growing our trading community and providing education and support for your trading decisions. Please feel free to share this with your friends and family if you find the information beneficial.

Related Posts