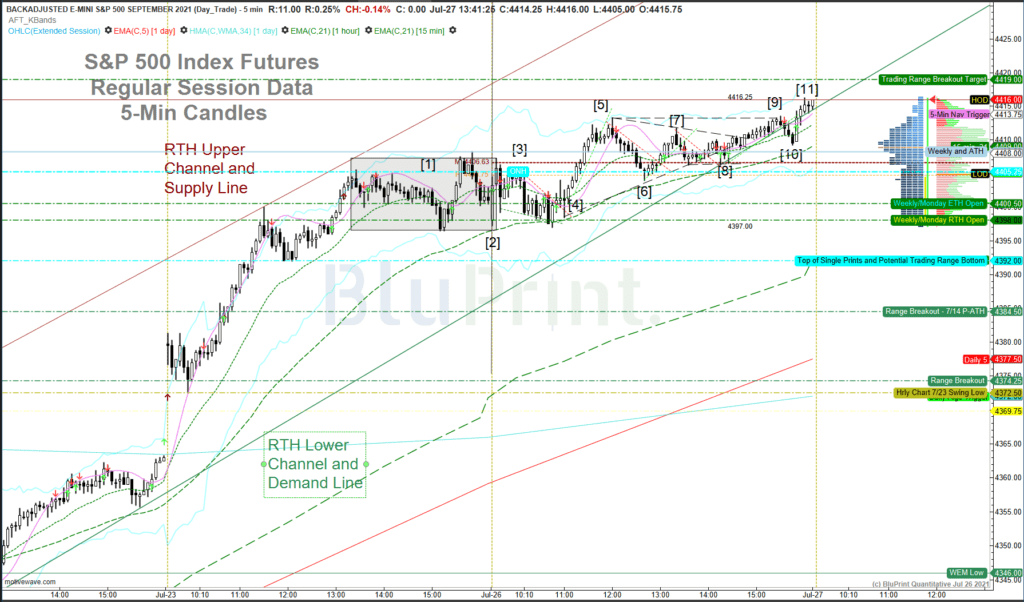

The Narrative Corresponding to Each Number on the Chart Appears Below

The Narrative Corresponding to Each Number on the Chart Appears Below

The weekends always provide a respite from the daily grind, as well as some perspective. At the same time, that perspective can cause Monday trading to be a bit strange because investors and traders can change their minds about current positions. They promptly execute the changes on Monday morning. I skip trading on most Mondays as a result. However, they have been good trading days of late, so I had a productive trading day today, following one of my best day trading weeks of the year.

You want to come into Monday morning with an open mind, seeking all relevant trend lines, moving averages, Navigator Algo indicators (proprietary), patterns, cycles, Weekly Expected Moves (WEMs), and other key levels marked on your charts. Having the weekend, you also should have updated your monthly, weekly, and daily charts. To the extend any of those lines, indicators or key levels should present during the day, you want to make sure they are reflected on your intraday chart (I use five minute candles). It is easy to get lost in the minutia of the 5-minute candles and miss the big picture.

In this analysis, I will focus on the regular session (RTH) candles from today only, with some reference to the overnight data. Keep in mind that much as I would like to, I am unable to do this detailed analysis every day as it is quite time-consuming. I will, however, publish it a couple of times a week.

The Narrative

Context is important as well. Everything starts with your ongoing narrative. You should be adding and subtracting from it daily. The narrative is that we have been in the throws of the 18-month cycle correction since April. Different sectors have taken the brunt of the correction . Overall, the correction has barely been noticeable in the S&P 500 index, our key market proxy and trading vehicle.

This muted presentation in the major indices is due in part to the rotational nature of the current market. Also, however, it is the result of the 4.5 and 9-year cycles bottoming at the Pandemic lows in March 2020. Similar to the past, the bullish forces associated with these larger cycles bottoming usually mute the impact of the first 18-month cycle dip that follows.

In the current market, the giddy sentiment and froth peaked earlier in the year with the GameStop trades. From there, the 18-month cycle peaked in April and has been correcting under the surface ever since. Of the major indices, the cycle can best be seen in the Russell 2000 index. The cycle also is visible if you look at the percentage of stocks over their 50-day moving average and other breadth indicators. In my view, the bottom of the cycle occurred a week ago Monday, on July 19th, and that is why we have experienced a rip your face off rally off that low.

You also want to know any key events that lie ahead this week. This week, we have earnings from a number of the key tech/growth stocks, as well as a Fed meeting on Wednesday. Clearly, these events can be catalysts for short-term change, though there is nothing draconian expected. Also, the market had been one-time framing higher for four five trading sessions. At the very least, the market likely will need a few days to consolidate soon. Also, the structure under the market when it is moving this fast is weak, and will need to repair as the market takes its next pause. Day traders, often weak hands, can get caught in bad location, leading to sudden liquidation breaks from time to time. With all of that in mind, we will move on to the chart legend for Monday.

Legend

The numbers below correspond to the same numbers on the chart above.

[

1] We had established a trading range Friday afternoon, which is highlighted in gray. Also, the Nominal 2-day wave and cycle dipped and bottomed in the overnight market. A “head and shoulders” reversal pattern coming off the Globex low and climbing up to the New York open marked the cycle low. After drawing in the trading range, you should have all your key levels marked as usual; (i) Friday’s high and low, (ii) the overnight high and low (ONH and ONL), (iii) the open (as soon as it is available), and the other key levels I cover in the Pre-Market Outlook.

[2] At [2], the New York Open, I was already in a long trade from the overnight reversal pattern. It would not have been easy to trade out of the gate at the New York Open itself. There was nothing to really guide us from the overnight session. The first hour was a sloppy, choppy mess.

Note that I am always running two screens, especially at the open. I run one screen with the overnight data off and one with it on. I prefer the overnight data included on my screens, but there is no right way to trade. Clearly, the regular session data is the most important because most of the volume occurs in the day session.

[3] From point [2], traders took the market up to point [3] to test the ONH, also the top of the trading range. This is the typical price exploration pattern we see every day. Traders test both sides of the market to find the path of least resistance.

The market failed at point {3] on a climax high (with the overnight data on it blew through the top K band), triggering a sell to cover my long position. The market also tripped a Navigator Algo sell trigger, a micro trendline break, and followed with a big bear bar down. I had a 10-point gain per contract on the trade.

[4] At [4], and having failed to take out the ONH (overnight high), the market reversed down to test Friday’s afternoon low, also the bottom of the trading range and the Globex Open from Sunday night. Recall that the Open is important as it defines a red versus green candle. We often say that screens go red or green around the world when the opening price in any time frame is breeched.

In this case, you should be setting up for a buy as the market wedged into the low, confirmed by a micro double bottom, a positive momentum divergence, failure to break down below the wedge, and a tag of the 15-minute 21-EMA (mean). A micro trendline break and the Navigator Algo trigger confirmed the buy a few bars later. A miniature expanding triangle also is visible at the low.

[

5] Moving off point [4], we get the best long trade of the day, a bull microchannel easily breaking the top of the trading range and setting up a measured move target of 4419 or double the range. The target won’t necessarily be reached before the end of the session but should be drawn on your screen. I sold my long position on the double top, negative momentum divergence, break of the trendline, and Navigator Algo triggers. The trade netted 10 points per contract.

[

6] Coming down from point [5], the market tests the halfback (50% level of the day’s range), a somewhat loose retest of the range breakout, and a test of the 5 and 15 minute 21-EMAs or means. The problem here is that while it looks to be a good trade, you have to decide if you want to make a trade over the lunch doldrums in New York and Chicago. By this point, the market’s tempo had slowed considerably. Moreover, the market internals had been somewhat mixed, with tech stalling and money flowing into Energy and Financials as predicted in the View from the Top Down this morning.

{7} By this point, it is clear that the market has moved into a mid-day consolidation and trading range, ending up in a triangle pattern. There is nothing to do until there is evidence that the consolidation is ending. If you took the trade from [6], you would sell on the micro trendline break. I took this trade but only made three points per contract after spreads and costs.

[

8] Here, you are now in the zone for the afternoon drive, but the slope is waning, as can be seen in the 5 and 15-minute 21 EMAs. I took a long off the failed breakout below the triangle, also a micro double bottom that bounced off the 5 and 15-minute 21 EMAs, confirmed by a Navigator Algo trigger and break above the triangle.

[9] I am out at [9] for 4 points per contract on the muted bull microchannel trendline break and Navigator Algo trigger. As a rule, I generally don’t trade the last hour unless I have a particular reason, like an anticipated short squeeze.

[10] This is the classic flush trade and bear trap discussed last week, good for a nice long trade into the close. In this case, I passed on the trade.

So there you have it, Monday morning play by play. I hope this detail helps you with your trading. This is how I do it, but it certainly is not the only way to approach day trading.

A.F. Thornton