Corrected Pre-Market Outlook – 7/28/2021

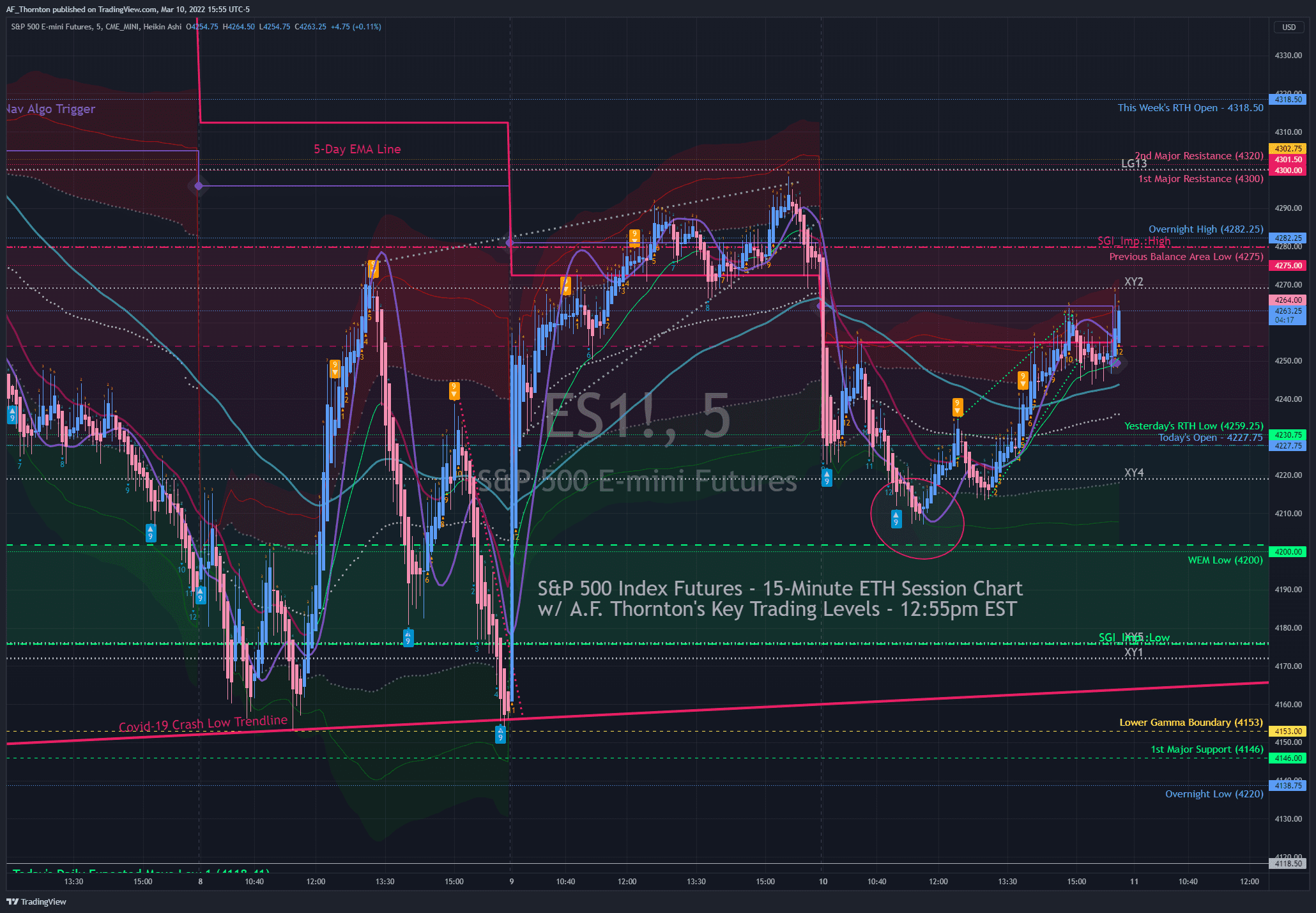

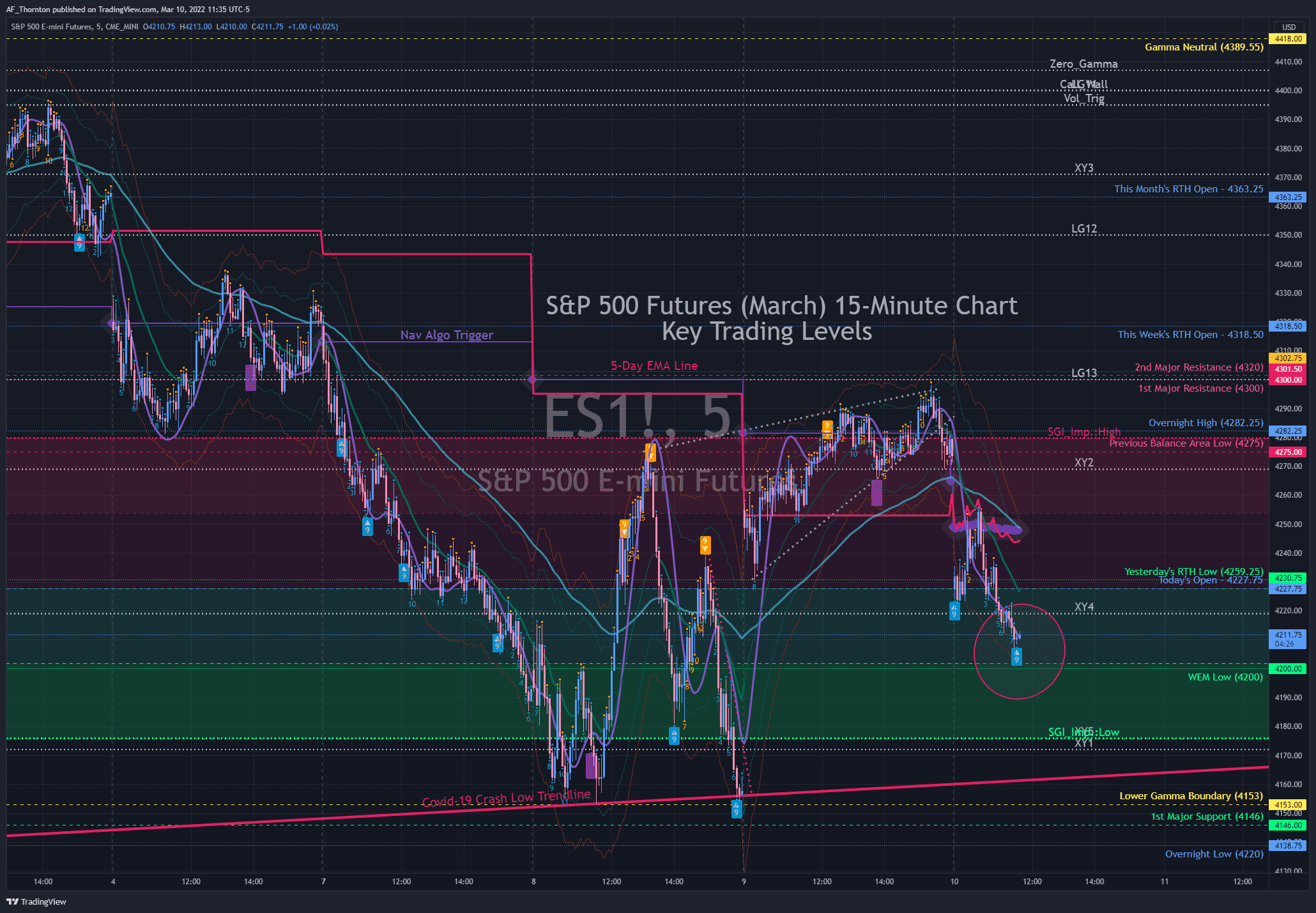

The big picture yesterday was the potential topping of the 5-day cycle. The line in the sand was Monday’s RTH low at 4297. The market gapped down at the open below all of the key MAs and this line in the sand. Once these levels were breached, you have to presume a bear trend with the next logical target as the recent gap top, also the breakout from the mid-July peaks around 4370ish.

From experience, I also know that the daily 5-day EMA and Algo trigger lines can act as magnets (and support). Yesterday, the lines sat right below 4370, and our triple POC’s from mid-July around 4367.25. As the first 30 and 60-minute ranges closed, I also had the opening ranges, and I could project a double the range target of 4364.75. The market bottomed at that latter target to the tick.

I added to our Navigator swing position at 4368.50 with a four-point stop. I believed this to be near the low of the day. The market ultimately bottomed 3.75 points lower, almost triggering my stop but ultimately bottoming.

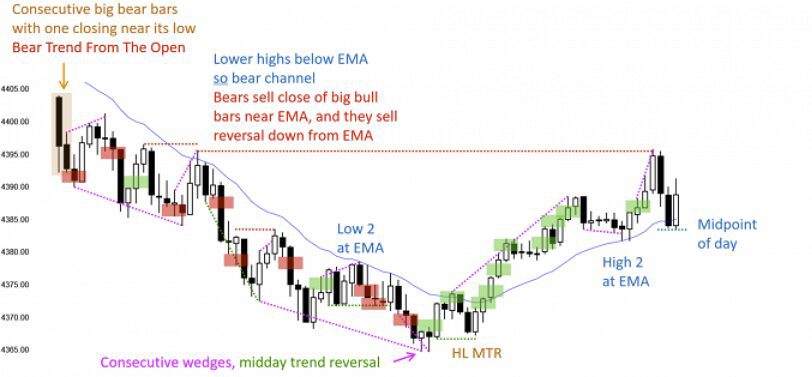

As far as day trading in the circumstances, you had the classic breach and retreat short trade. I also periodically shorted and scalped from the 5-minute 21 EMA or meant (blue line above), which is what you due in a micro bear trend. It is a little rough when you have two consecutive falling wedges. But the failure of the first wedge to turn the market was a great WWSHD moment and led to the best short of the day.

I also picked up a nice long trade on the mid-day reversal into the close. If you were unwilling to short, simply waiting for this turn and long trade would have been enough to make your day. Also, by this time, and having reached the target set in the morning, the put/call ratio moving back to .80 should have been a clue that the shorts would likely cover into the close.

If I get time today, I will send a legend with my notes. I am working on a voice-to-text methodology that would make communicating the details easier.

Today’s Plan

The market seems to be reacting positively to yesterday’s post-closing earnings announcements. Today is Fed announcement day, so I won’t be trading and plan to work on the video I have been trying to finish. Usually, the market goes sideways into the announcement. But with the Delta China Virus strain threatening the economy, I don’t expect any changes from the Fed.

As outlined in the interim update to View From the Top Down this morning, the July 19th low at 4224 is THE key line in the sand at the moment. Carry that forward. Shorter-term, yesterday’s low at 4364.75 should also be carried forward as a reference. We are still trading in the vicinity of the 5-day EMA, which continues to be our stop for the Navigator swing trades, but could still present on your day-trading screens.

Overnight, inventory is net-long with an overnight high of 4404.50. We are trading inside yesterday’s range, so no clues for the open. I would keep an eye on 4404.50, where some reference points congregate from the last few sessions, such as yesterday’s regular session high and the VPOC from Monday. I would also watch yesterday’s value area low at 4376.25.

Good luck today.

A.F. Thornton

Related Posts