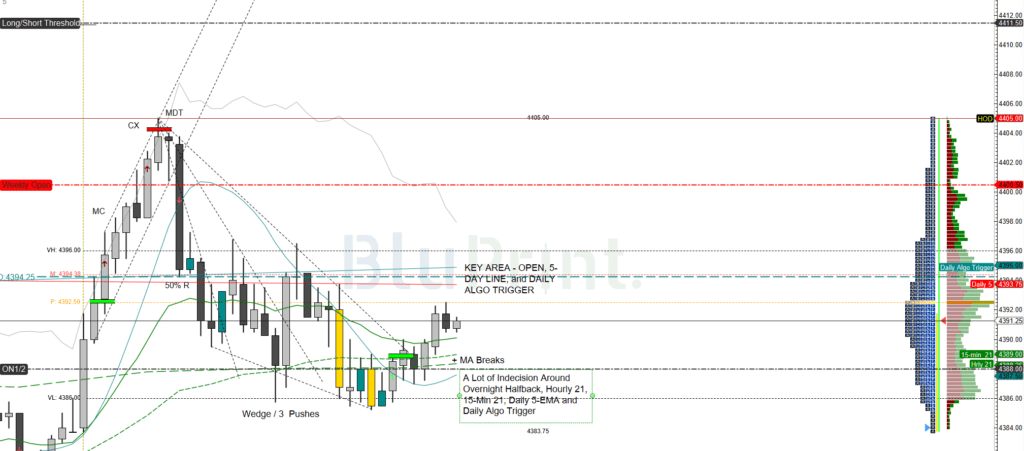

I have only made one round trip this morning for about 10-points per contract. The buys are green, the green horizontal bars, and the sells are the red horizontal bars at the trade locations. I am in a second buy off the falling wedge reversal into the double bottom at 4386 at this writing.

We had a surprisingly strong bull microchannel off the open, and I bought the close of the second bull bar. I sold on the climax bar that broke out of the channel. I planned to buy the first retracement, but the bear bar was too big. Where I sold, you could also have shorted. However, I was reticent to short against such a strong bull opening that filled the entire gap down this morning.

From there, we formed a sloppy, choppy falling wedge, typically a reversal pattern to go higher. There were many scalp trades in that region, but I don’t tend to be a scalper.

The area (also identified as one of our key levels today at overnight halfback) provides much indecision because all the 21-period and Algo lines congregate there from the various upper time frames. Traders have been going back and forth, trying to find the path of least resistance.

More importantly, up around 4394 is where the 5-Day Line (our Navigator Stop Line) and the Nav Trigger on the daily chart sit. We want to close above that level today to stay short-term bullish.

By the way, black bars are down bars; grey bars are up bars. Yellow bars are outside bars, and green bars are inside bars.

So I am currently long against the double bottom and wedge reversal. Today likely will end up a trading range so that the morning high might be the target.

One final, important note. The Put/Call ratio is back above .75. The shorts are not getting what they want so far today. Given that the last hour today is the end of the month and week, we usually get a big move anyway. I will be looking for a potential short-squeeze.

A.F. Thornton