It is hard to complain about the opportunities presented for day traders in the past two sessions. Today was better than yesterday in that it kept our swing positions in the game, but that is for another strategy.

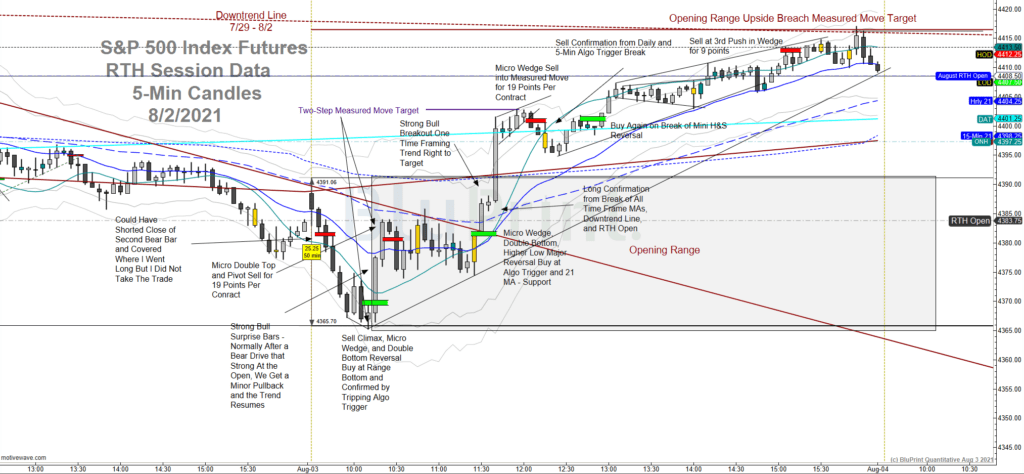

The morning started with the bears driving the market viciously lower into a selling climax. A bull, major trend reversal followed, starting with a couple of bull surprise bars. This gave us a long position with a clearly defined two-step target and an opening range break target right above that. Price tagged both targets almost to the tick. The day ended as an outside-up day in the RTH session since we briefly fell below yesterday’s RTH low and broke above yesterday’s RTH high. I wasn’t as lazy as yesterday, putting 39 points per contract on the board.

There were more trades available than marked above. I skipped the morning short trade. I was too screen fatigued to scalp the bull channel rising into the end of the day. As the rising wedge and channel progressed, I took more of a buy-and-hold approach on the last long trade until we reached the opening breach trade target.

Stepping out to a two-hour chart, I threw a bit of Wyckoff analysis on the trading range. We now have a decent chance of breaking out, though I take nothing for granted. This morning was a shakeout, falling below yesterday’s low and bouncing right back. It would have been better to take out the first low in the range, but this was close, almost to the tick. A flush like this generally acts as a spring for a rally to end the trading range. Supply is finally exhausted, along with the weak hands.

The main fear I have is that this consolidation pattern can also act as a final bull flag. In such a case, we could look above and fail tomorrow, resulting in a bull trap. We need to be on guard for the possibility. Otherwise, we can begin to target the uncompleted measured moves above us, more clearly defined on the daily chart below, and previously discussed in these pages.

I was also pleased to see our swing positions in Energy (XLE) and Financials (XLF) leading the pack for most of the session. We have been betting on a turnaround and rotation into both of these beat-up sectors, but concerns about the economy (in light of the latest Covid scare) could spoil the best-laid plans.

As always, I will stay vigilant.

A.F. Thornton