Mid-Day Update – 8/17/2021

As I had suspected, yesterday was somewhat of an anomaly, making me highly suspicious that the Fed intervened in the market to cushion the Afghanistan news.

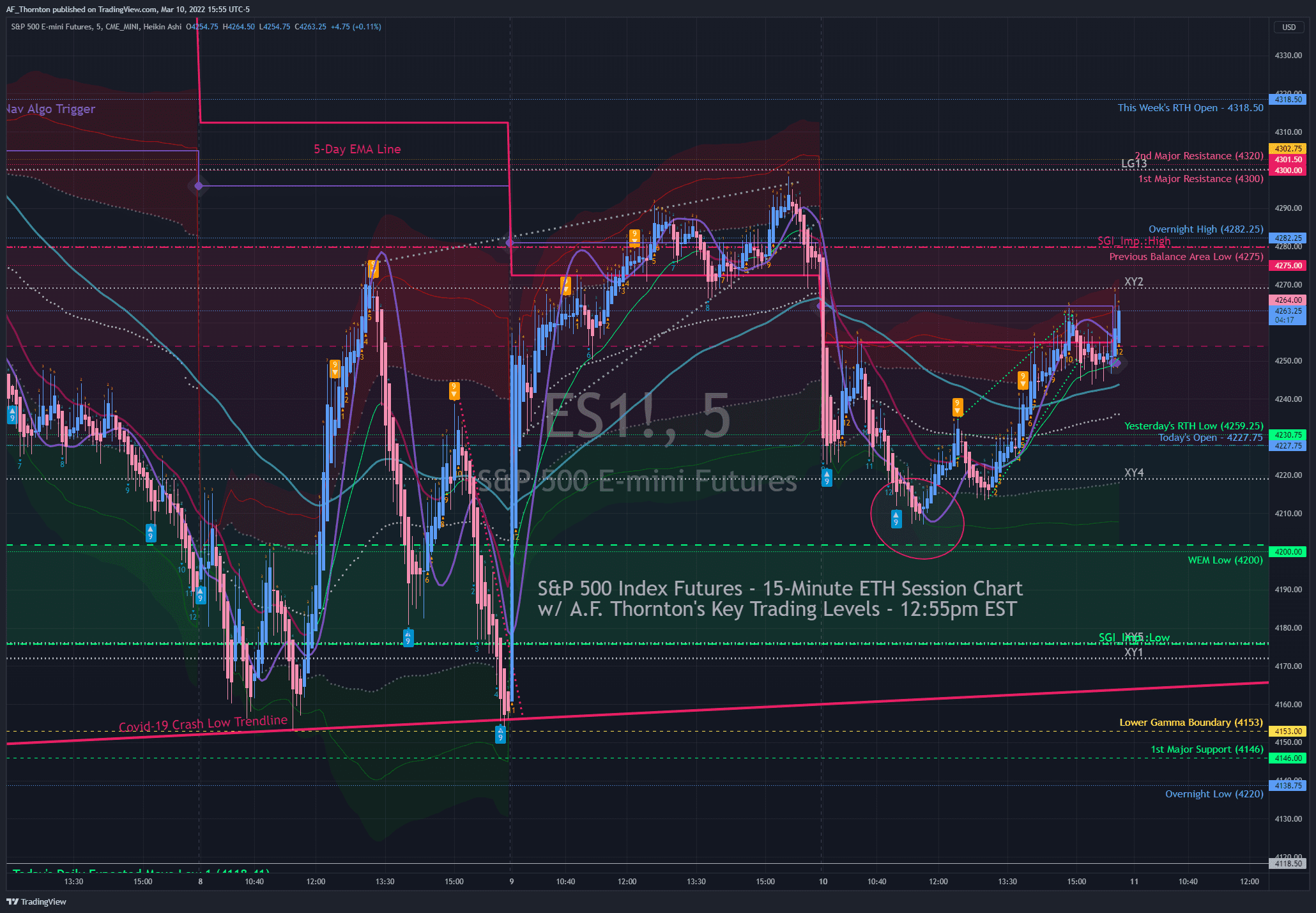

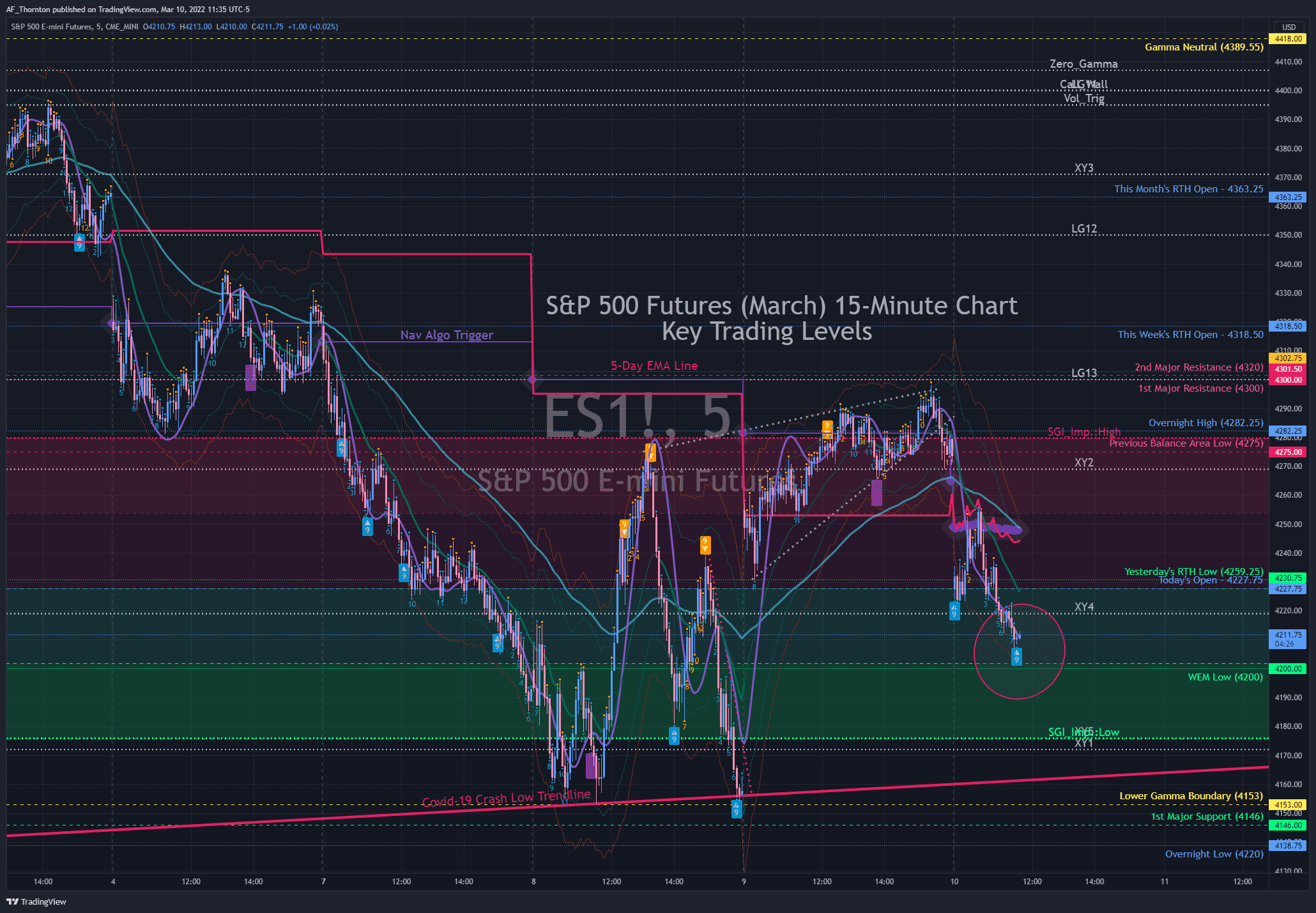

So it appears that the 40-day cycle markdown has resumed. But with the CBOE Put/Call ratio at the highest level we have seen all year, I do expect a short-covering rally at some point today, perhaps even into the close.

I would target the 21-day EMA on the daily chart as the first reference point and target for the cycle low. From there, you can double the decline if the 21 does not hold and then target the 50-day line.

A.F. Thornton

Related Posts