I have been posting the technical notes that I keep throughout the day, week, and month. Of course, this practically includes a note on every wiggle of the index. What I will be doing from now on is posting that on a separate website page every day and trying to stay with the most important notes that affected the day and the best trades.

Friday’s Epilogue

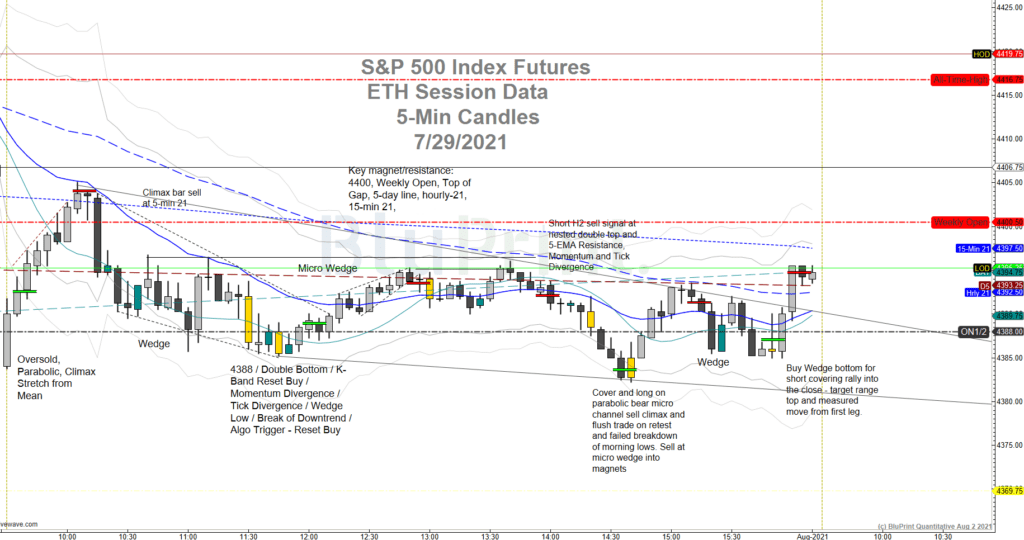

Friday started with a True Gap down (open lower than the previous day’s low) driven by the Amazon earnings miss the night before. Gap Rules were in play. Note that I will be expanding the Gap Rules definition to include the four most common chart patterns that appear when Gaps are presented.

The market started unduly stretched below the 5-minute 21-EMA (mean) because it was a huge gap. So, depending on overnight inventory, traders typically attempt to fill the gap by running a test back up to the mean. The test usually fails, and the market can reverse several times before it takes a direction, which can often be sideways or no direction at all on a huge Gap. The playbook is the same whether the gap is up or down.

Friday’s case had two features of note, both mentioned in the Pre-Market Outlook. First, traders were 100% short overnight which left them vulnerable to a short-covering/inventory liquidation rally at the open. Second, while a serious earnings disappointment in a key name, Amazon’s earnings miss did not reflect a systemic problem.

As far as key levels, the weekly open, 5-day stop line, daily Navigator Algo trigger, 5, 15, and hourly 21 lines (means) all congregated as resistance to any rally around 4400, which is a roundie (important psychological level).

As mentioned in the Pre-Market Outlook, the mid-point of the overnight range was 4388 and would be my barometer of strength for the day.

Indeed, the conglomeration of aforementioned magnets became the resistance, and 4388 marked the bottom of the range for the most part.

So the market started with a parabolic micro-bull channel short-covering rally. It nearly filled the gap in the first 30-minutes, stalling at the loose juncture of our magnets and resistance. The tag of the 5-minute EMA on a climax bar was the reversal top.

In this particular Gap scenario, parabolic strength in the first run usually negates the risk of further declines in a downtrend day. Instead, the market typically wedges into a retest of the morning low and gap bottom l by mid-morning (Eastern Time), then makes another rally attempt to punch through the mean.

On large gap days, the retest usually fails, and you end up in a trading range the rest of the day, perhaps with another run at the low and high. As a bonus Friday, the put/call ratio shot up to .80, which is in the extreme fear end of the recent range, setting up the shorts for another short-covering rally before the day’s end. This can be uniquely advantageous on Fridays as the shorts would be reticent to hold over the weekend.

All in all, the day ended up as a trading range with a slight downward slope making it technically a bear channel and a dance around our 5-day stop line. To keep it interesting, the market literally closed on the line. I managed to get five nice trades on the day, four longs and one short, for a total of 35 points per contract. Add this day to your notebooks, as it is one of the four typical patterns we see on gap days.

Today’s Plan

The market is slated to open with a slight true gap (open higher than Friday’s high). If so, that leaves an island reversal from Friday, and Gap Rules will apply today, but in the opposite direction as Friday. If we don’t open outside Friday’s range, gap rules are negated.

Key support should be Friday’s magnets around the 5-day line. A good proxy for this is Friday’s RTH high at 4405, but no lower than the overnight low, and Friday’s CME settlement price at 4394.75. The target is the overnight high at 4422.50, which is a poor high, as carried forward from last week.

So take the usual tack. As overnight inventory is 100% long, look for an initial fade and some profit-taking.

Value has been relatively unchanged for six daily sessions now. Although we are gapping up a solid clip from the Friday settlement, remember that a true gap is measured by how far it is above Friday’s regular session high at 4405. By that metric, the gap is very tiny thus far. We are also right in the middle of the aforementioned value areas.

For these reasons, the opening trade may not be as clear as you would think. When deciding if shock and awe is truly a factor on any open, always consider where the current price is in relation to Friday’s high/low, settlement, and the overall overnight range.

Good luck today.

A.F. Thornton