The morning outlook will follow. This Epilogue is lengthy, so you may want to save this for a later time when you can really sit down and focus. Then start by clicking on the above chart to enlarge it. Either place it in a separate window or print it so you can follow along. Study and repetition are as important in day trading as with any serious endeavor. The market rarely has any new moves. The moves have all happened before because human nature does not change. We capitalize on that concept for one of our edges in trading.

Some setups do stop working in time. We expect that. When everyone starts doing the same thing, it tends to cancel out the setup. To the extent required, I stay on top of the waning popularity of any setup as it loses its edge. Edge is what this endeavor is all about.

But typically, maintaining my edge is not a problem. The reason most of what I teach here does not tend to change or lose its edge is that I teach you how to “think.” Thinking is in short supply everywhere these days, and trading the financial markets is no exception. You might understandably yearn for easy, rote, and mechanical responses to the markets. Who wouldn’t? If this – then this. But the truth is that mechanical rules have their place but are not the end-all. Even I don’t solely rely on my mechanical algorithms.

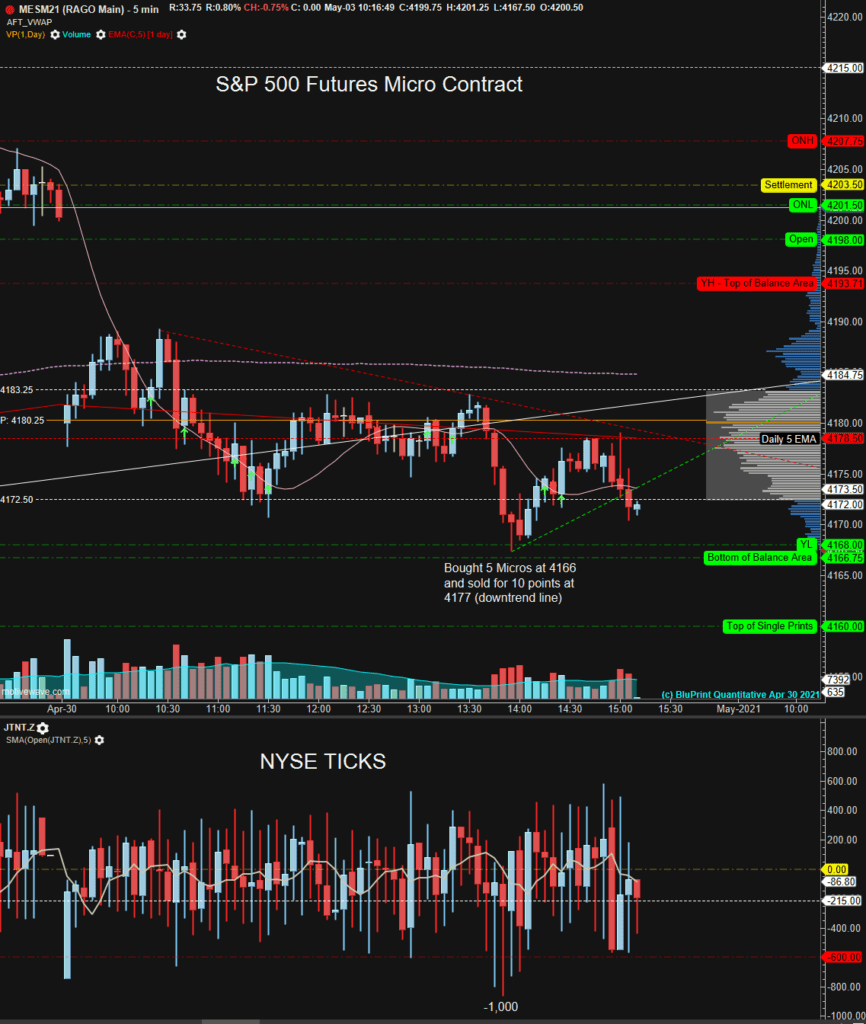

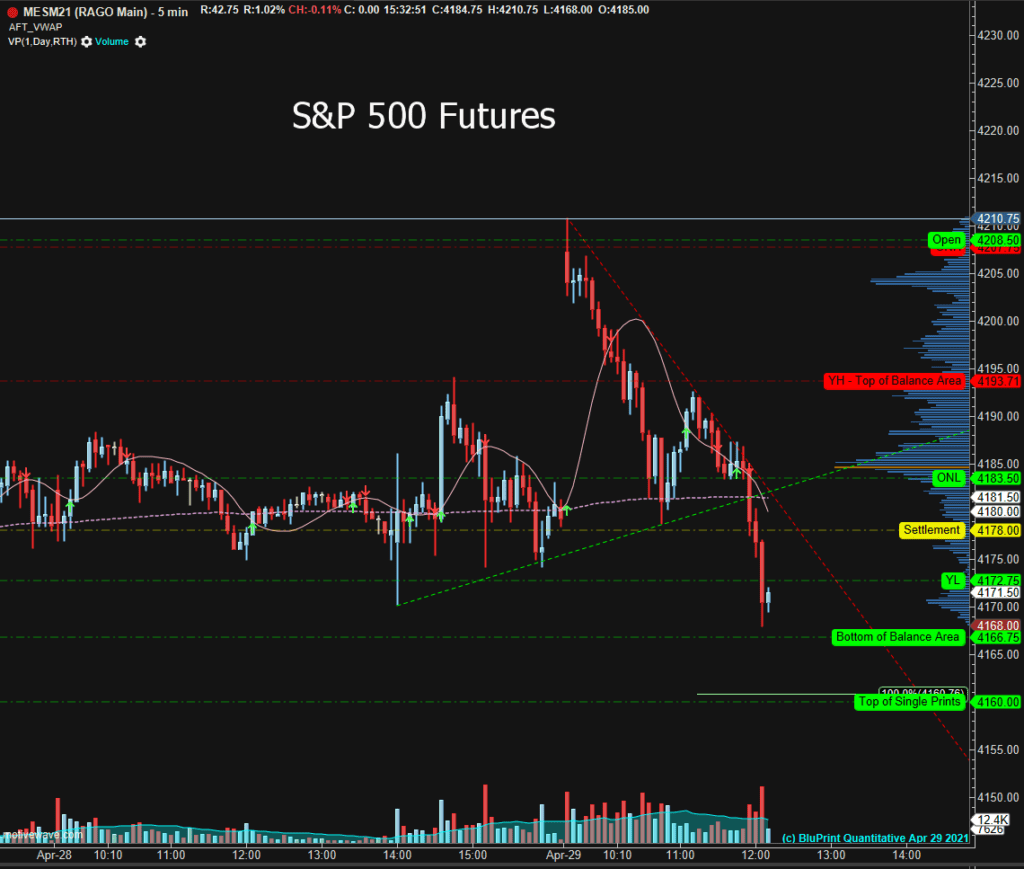

All that being said, today was a fabulous day trading day and one for your notebooks. Grab the chart, print the Gap and Balance rules, and print the morning and interim outlooks. Now, let’s relive the day, starting with the pre-market outlook.

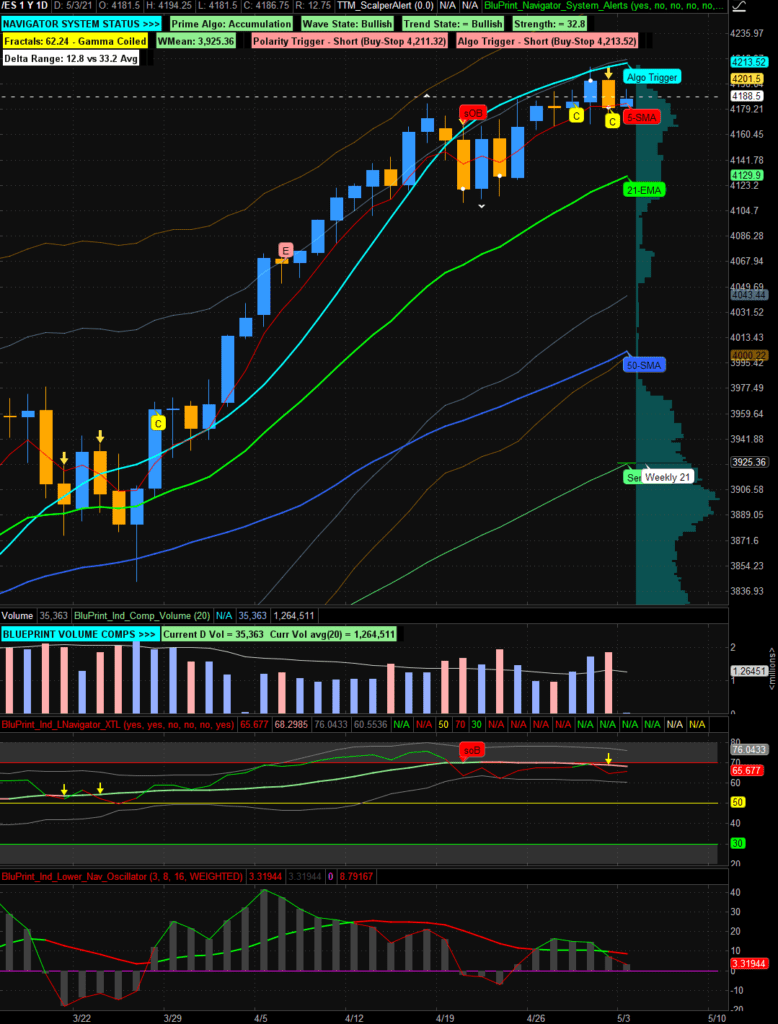

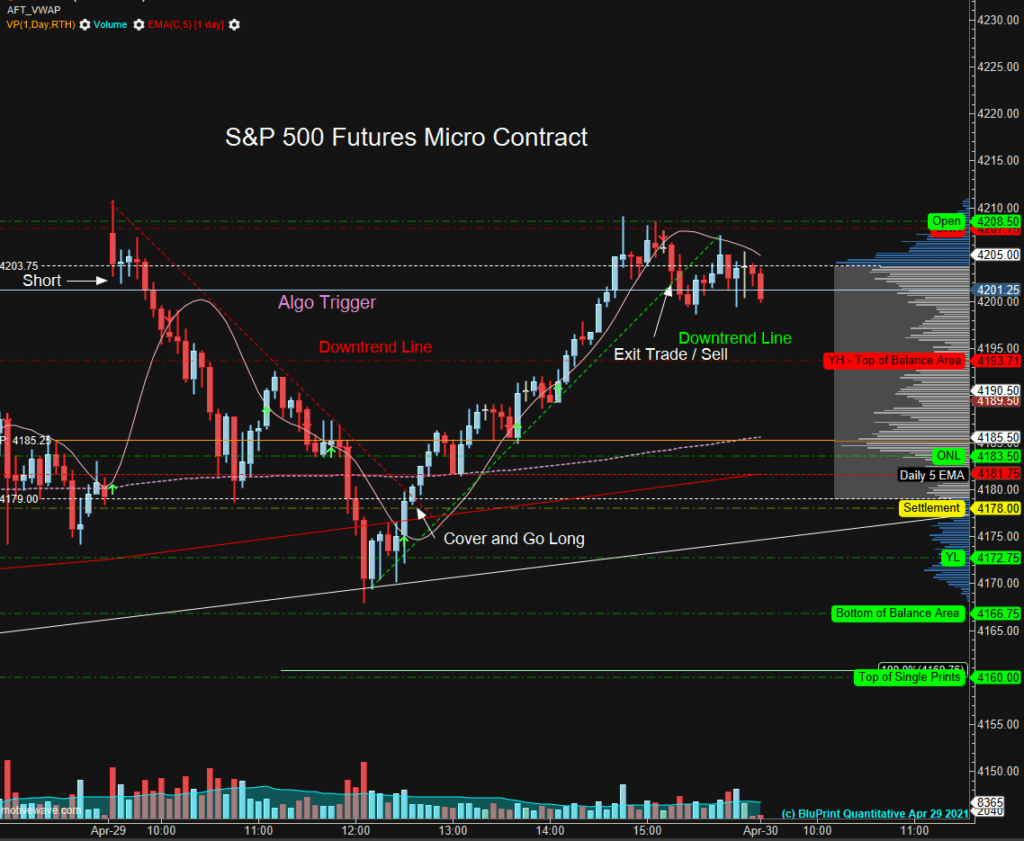

Summarizing, I noted pre-market that a combination of Balance Rules and Gap Rules would be working together at the open. I cautioned that recency bias might lead you to believe that Balance Rule #2, “Look Above Balance and Fail,” would be unlikely to apply. I cautioned you to keep an open mind. Sure enough, the rule prevailed.

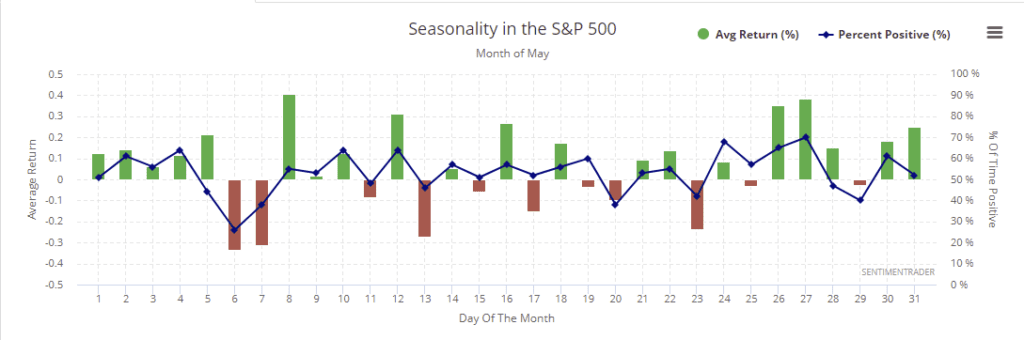

When the market gaps above a three-day balance area, by definition, the market is subject to a reordering of thinking. The reordering question is; will market participants accept the new, higher overnight prices or reject them? That is how the auction process works. Equally significant today, the top of the balance range at 4193.75 was the ceiling for the last eight market sessions. A breakout of eight-day resistance was even more consequential in the context of a “Look Above and Fail” related to the three-day balance range.

The measured move for a break out of balance is double the balance range. Yesterday (Thursday, 4/29), the market opened at that calculated move. Perhaps that was one indication that the opening gap would start to fill, and traders would test the validity of the breakout by forcing the price back to the range top level.

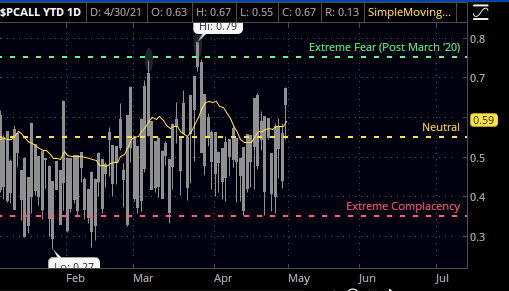

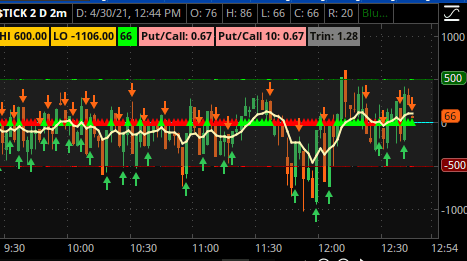

Significant gaps such as the one today don’t always fill the same day, and many times the market goes sideways the rest of the day digesting the new gains – a form of price acceptance in and of itself. Other times, especially on smaller gaps, you can have a “Gap and Go” scenario where the market blasts out of the open market and never looks back. Strong internals usually supports Gap and Go (e.g., breadth, advances versus declines, advancing volume versus declining volume, and up versus downticks).

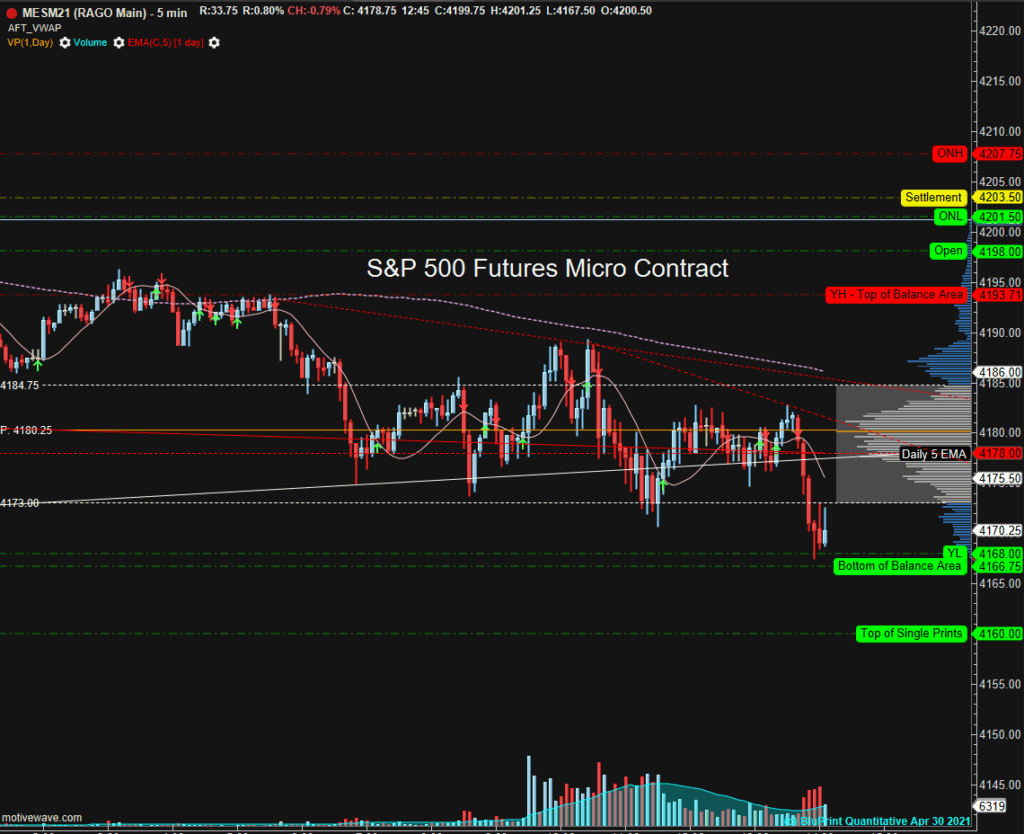

Also, this morning we came into the session with overnight inventory 100% long – so we would expect a counter-auction at or near the opening. I even suggested shorting a violation of the low of the first one-minute bar as a starting point in the pre-market outlook, with a stop a few ticks above that bar. For the first half of the day, that is all you had to do. But even without that more sophisticated approach, you could have followed the applicable balance rule as set forth below:

“Look Above and Fail. Prices move above the balance area high but fail to find acceptance and reverse back into the balance area. Now you have a short trade, with your stop above the high just made above the balance area, with a target to cover at the opposing low end of the balance area.”

Using my suggested, sophisticated approach this morning, I teed up a five-minute candle chart with all key levels marked. (By the way, I do this every day, and so should you.) I then shorted a violation of the low of the first one-minute bar using the S&P 500 E-mini futures as my instrument of choice. I executed at 4204.50. Subsequently, I had to ride the trade up a few ticks, and then the index rolled over in my favor.

Let me briefly digress here to say that you could have used the same approach with the NASDAQ 100 index, other stock indexes, and sometimes individual stocks. My instrument of choice turned on sector leadership out of the gate this morning, which favored the construction of the S&P 500 index. Making the appropriate trading vehicle choice will be a topic for a separate discussion down the road.

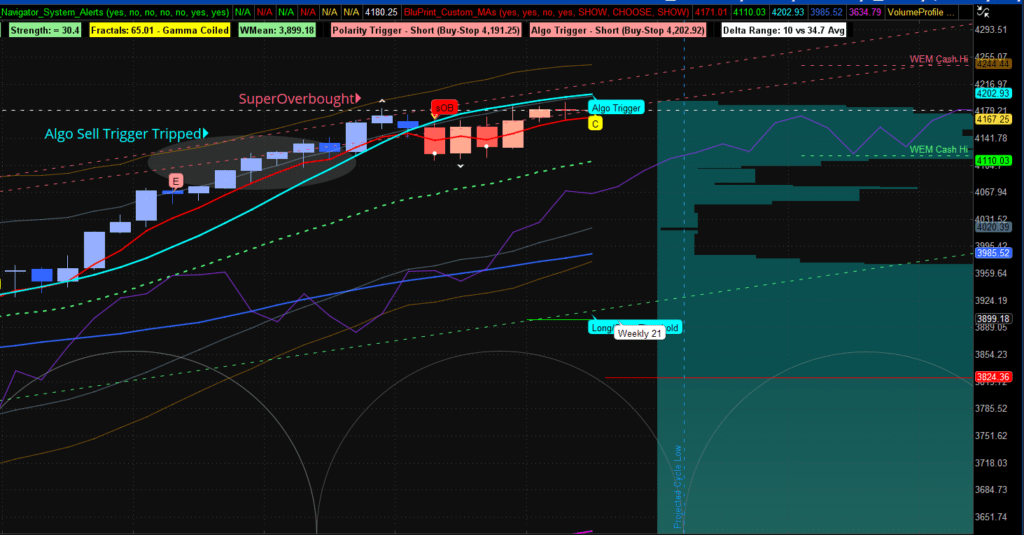

So, now I am in the short trade, and I followed price down to the top of the balance area at 4193.71, using a dual violation of a downtrend line and the Navigator™ Algo Trigger as my trailing stop to lock in profits, as the market moved lower and in my favor.

The top of the Balance Area at 4193.71 was my first logical target, as Balance Rules are not triggered until price materially enters into the Balance Area, but the rules anticipate such a retest. I was also motivated by a rational, anticipated counter-auction to correct overnight inventory. As well, a full or partial Gap-fill was a reasonable expectation, given that the market already opened at the targeted, measured move of the breakout from balance. So far, so good.

At the initial target, the top of the Balance Area, the index barely hesitated and soon cut right through the balance area top and right into the balance area. I had not been stopped out as yet, so now I had my second target – generated by the Balance Rules – the balance area low around 4166.

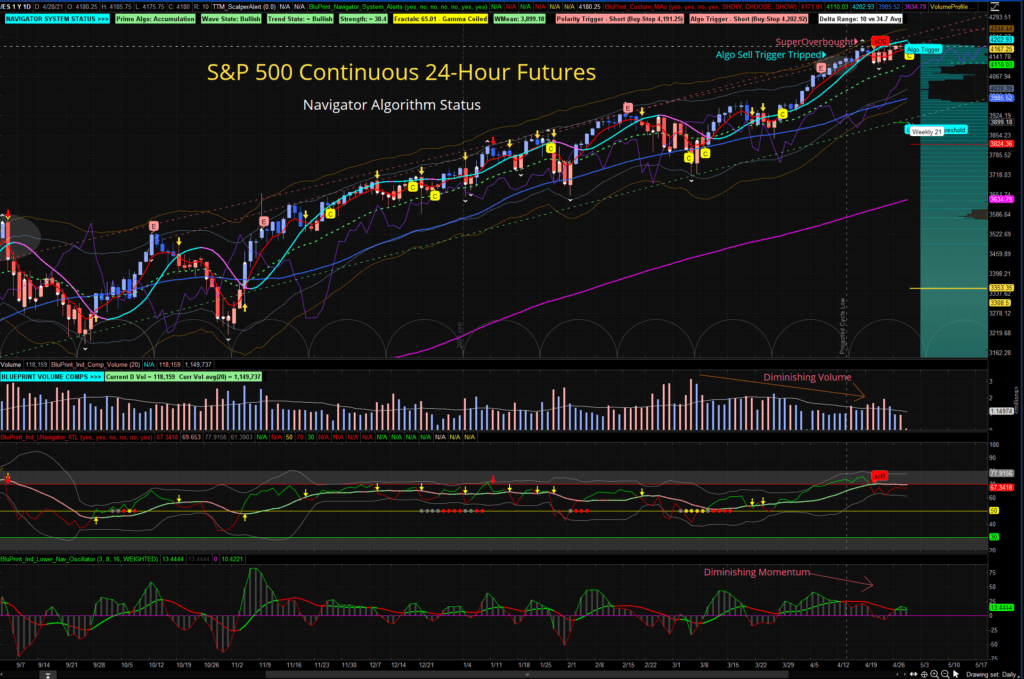

There was no guarantee that the market would reach or stop at the Balance Area low. With the appearance of a critical reversal top developing on the daily chart intraday, the market could have deteriorated further, capitulating and solidifying the nominal 18-month peak.

While I still expect that peak around the first week of May, we are in the zone for the peak even here and now. For the most part, however, I was 90% sure that the market would pivot higher from the expected target, and I sent out the interim update this morning literally as the market approached the Balance Area low at 4166. You can observe the position of the index from the chart included with the morning’s interim update.

Even though I was almost sure price had achieved the target, if the market wanted to further capitulate for more gains, I let the trade ride up a bit, allowing the market to take me out of the trade with a violation of both the trigger stop and a trendline break.

As a result, I covered my short positions at 4178 or $1500 per contract. The day margin on the contract is $550. So, I used $550 of my capital for each contract to make $1500 (triple my investment) in just a few hours. Had I used a micro, the profit would have been $150 per contract, using $55 of capital for the margin.

By the way, the advantage of trading multiple contracts is that there would be nothing wrong with covering a few of them near 4166, picking up another 10 points or $500 per contract, and letting the remaining contracts ride on the original plan. Always keep that in mind, including using multiple micros if you don’t have the capital to trade multiple E-minis.

Better yet, you could also do what I did today – if you can make the mental leap. One of the most challenging things for a trader is to instantly switch gears from long to short or short to long. It is a complex mental shift and not always appropriate. Sometimes I can do it, sometimes not.

It is usually easier to switch gears when my first trade has already gone substantially in my favor, and I am using setups or specific rules to guide me. Otherwise, it is best to take your trades in the direction of the prevailing macro trend – currently bullish.

The point is, using the rules and our recent narrative, you will realize that the signal to cover my shorts was a simultaneous buy signal, which I gladly executed.

Most trading systems, including mine, have a reverse button. So now, I reversed the short trade to long, using the same algo trigger I had used on the way down and a new, rising uptrend trendline as my stop to lock in profits as the new trade moved in my favor. The new trade was the mirror image of the earlier short.

It is not always clear where the up target will be in such a reversal, and I did not necessarily expect the somewhat rare “V” bottom we experienced today, but that is what the market delivered. Usually, the market would recover about half the decline and then roll over again, perhaps providing a third trading opportunity.

So now I am long at 4178, moving my stop up with the trigger and trendline. The algo trigger/trendline break sell signal came late in the day at 4202 for a profit of $1200 per E-mini contract or $120 per micro. The entire intraday swing trade delivered $2700 per contract for me. But for many, even $270 per micro would have been more than acceptable. It all depends on your risk tolerance and account size.

In conclusion, then, I started with a bit of thinking, followed by a reliable setup, adhered to the setup rules (with a dose of some technical analysis), and the rest is history. That is your “Look Above Balance and Fail” trade.

I hope this has been instructive. Feel free to email me at info@BluprintTrading.com with any questions.

A.F. Thornton