Morning Notes – 3/11/2022

Good Morning:

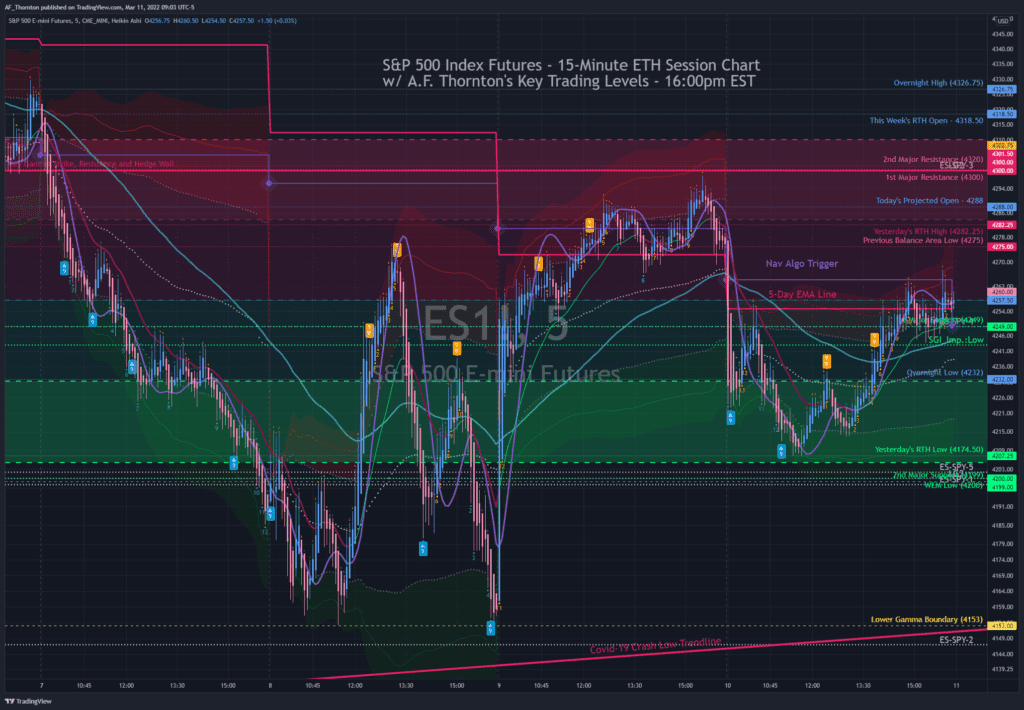

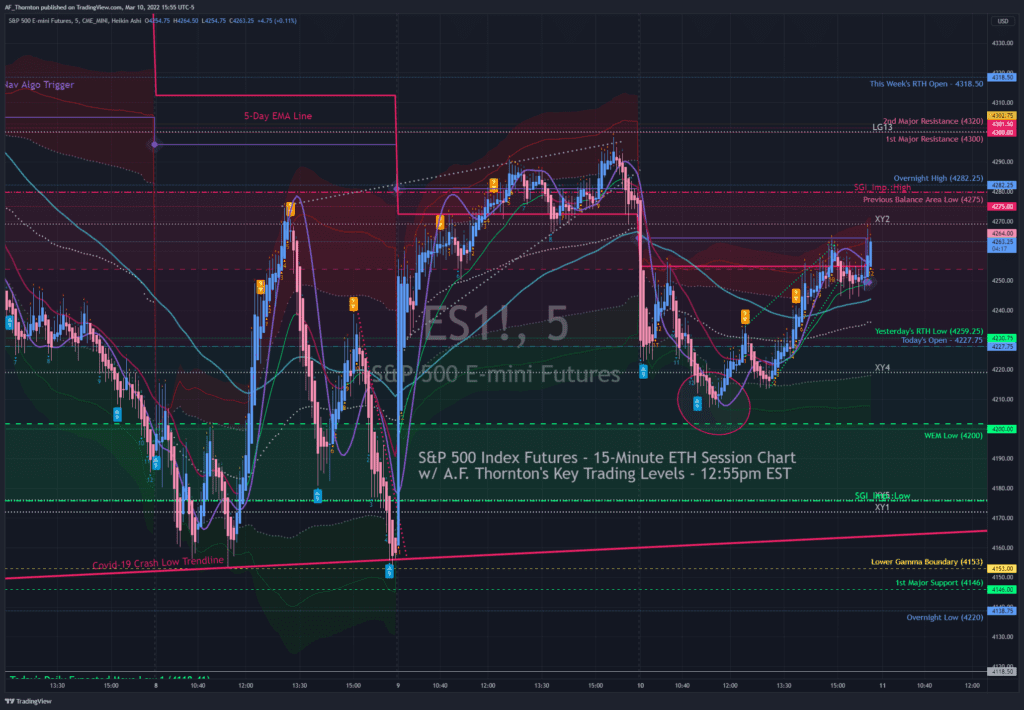

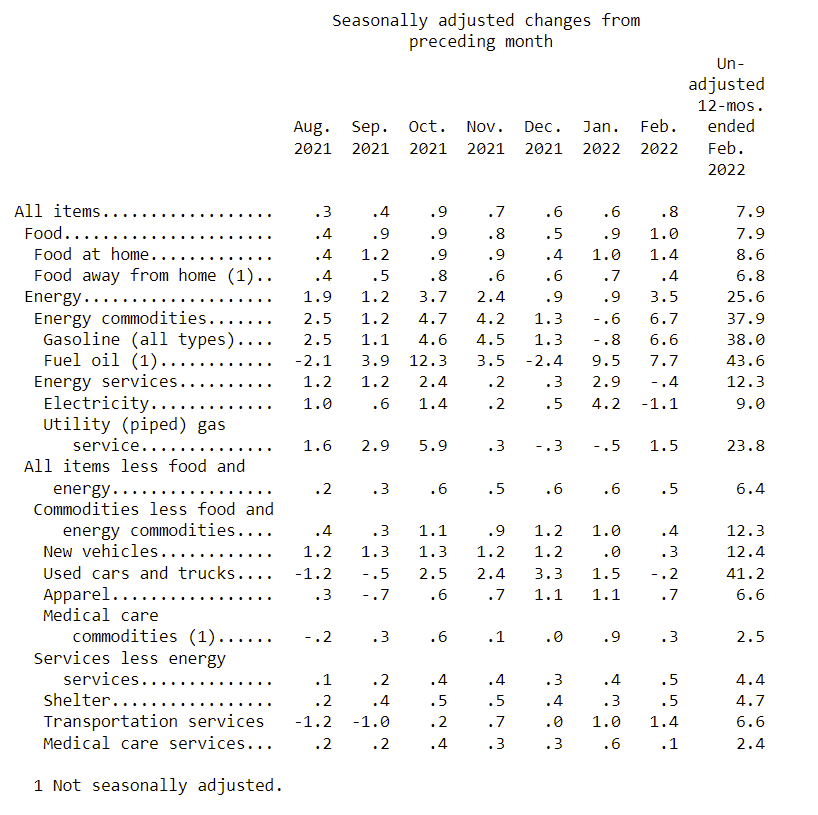

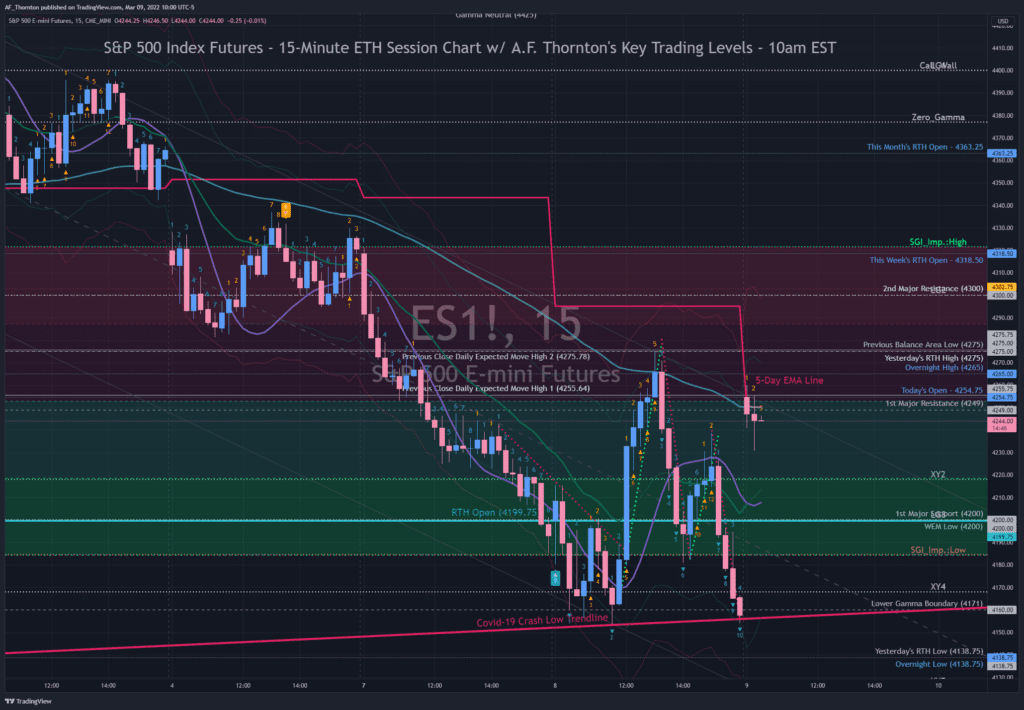

- I usually arise at about 2:30 am PST. So as I was executing my morning routine, I saw the Putin Pop hit the market at about 3:20 am PST. Initially, the S&P 500 jumped 70 points, right into our resistance wall between 4300 and 4320.

- Apparently, Putin reported some positive progress in the talks with Ukraine. He is a master of deception, so it is hard to gauge the truth.

- For all I know, his finance minister came to him and said, “Hey Vlad, do you feel like running a short-squeeze over in New York today?”

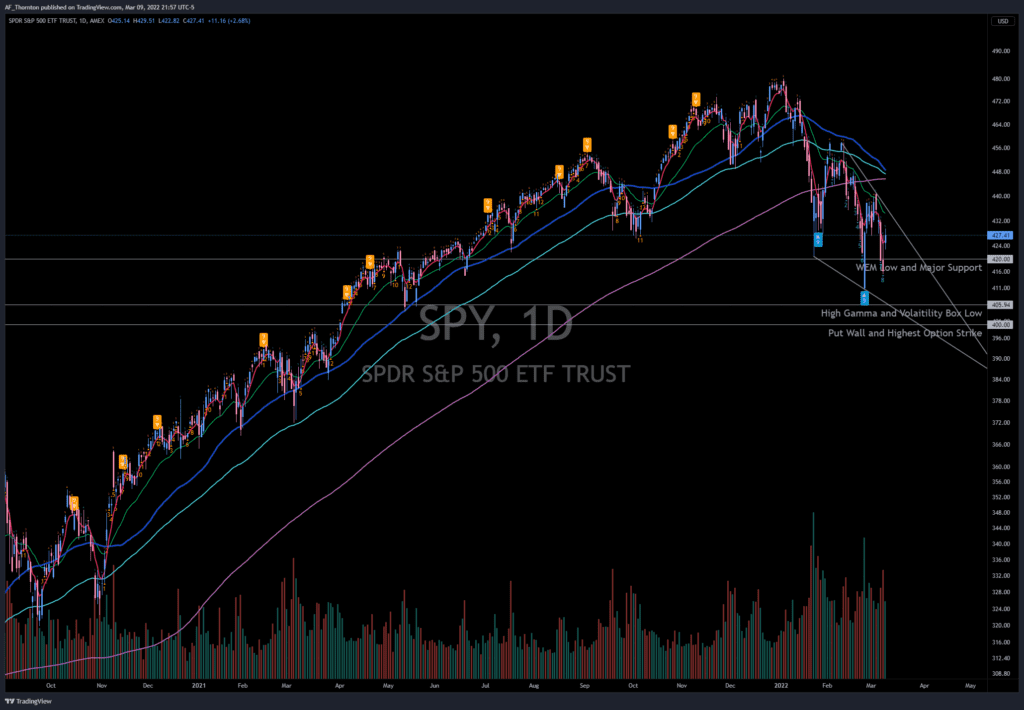

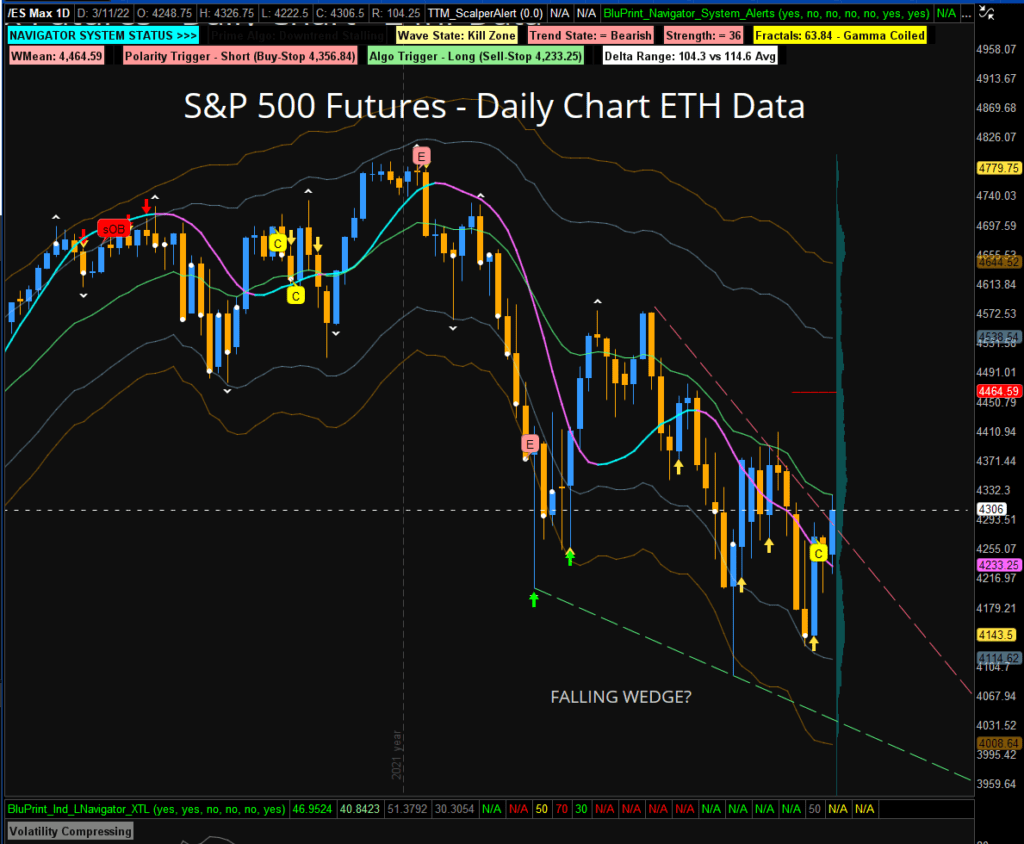

- And that reminded me of what I have been telling you all week. It is too late to initiate shorts here without copiously managing the trade. There are too many outstanding shorts at the moment, and the indicators show that rally risk considerably exceeds decline risk.

- With all the fear and negative news, you have to be betting on a nuclear event to cash in on shorts initiated from current levels. As I said a few days ago, if that is what you believe, you need to make sure you will still be around to collect.

- There will be more chances to bet on lower prices ahead. Let’s wait for some higher prices.

- My quant calculations can go out the window in a news-driven market like this morning, but I will give it a go on some ranges.

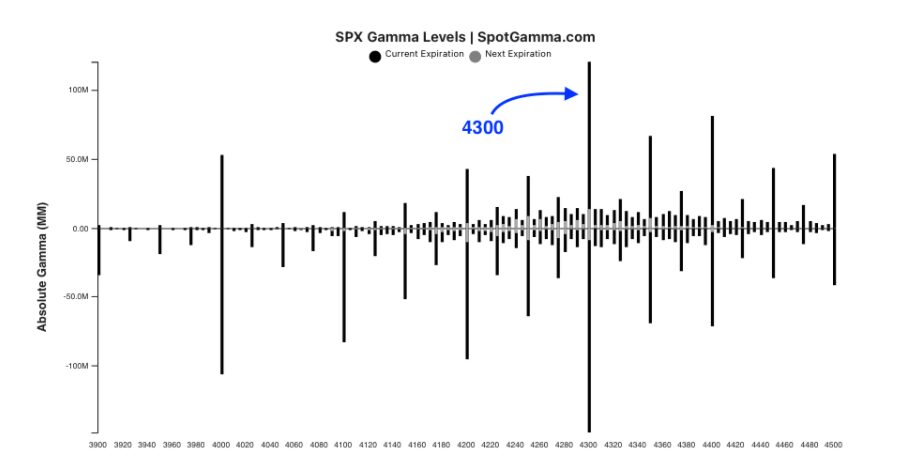

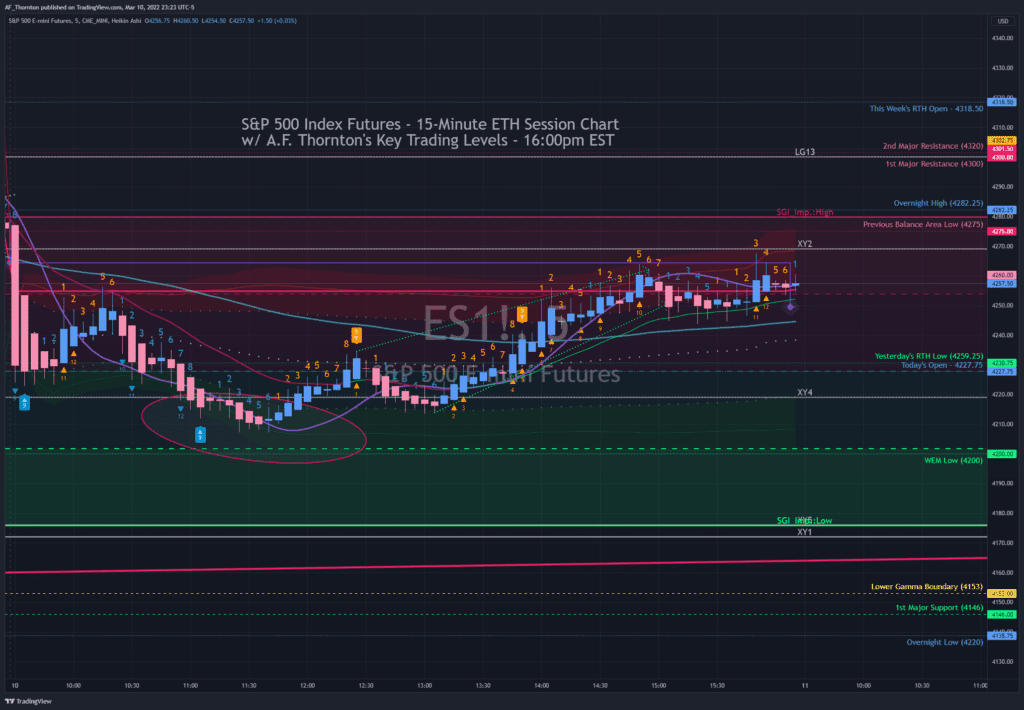

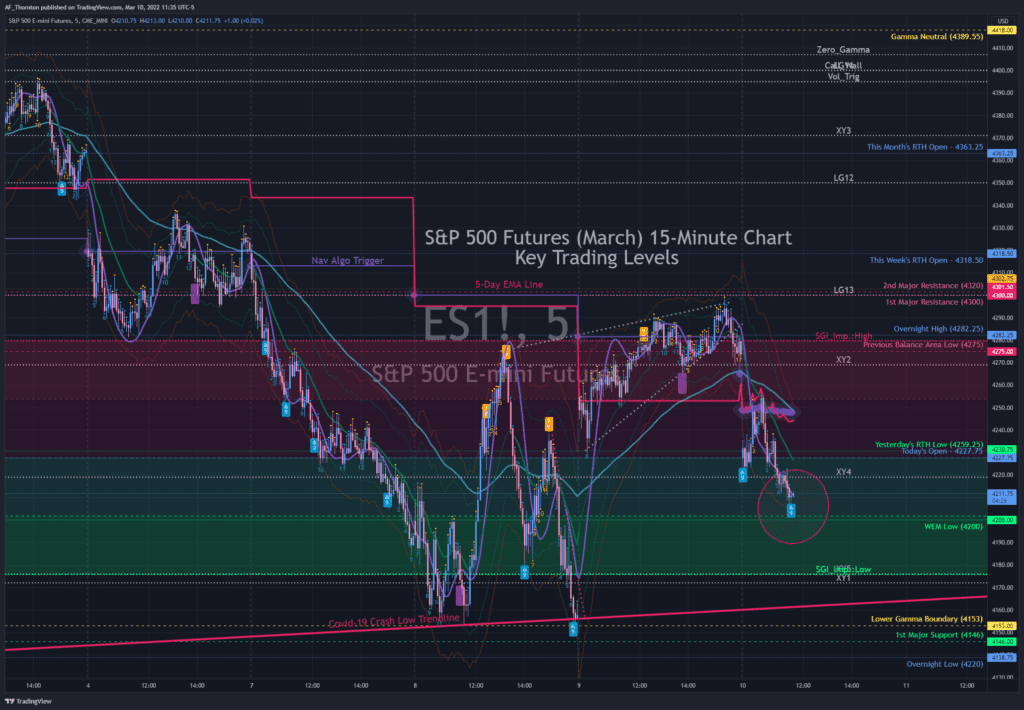

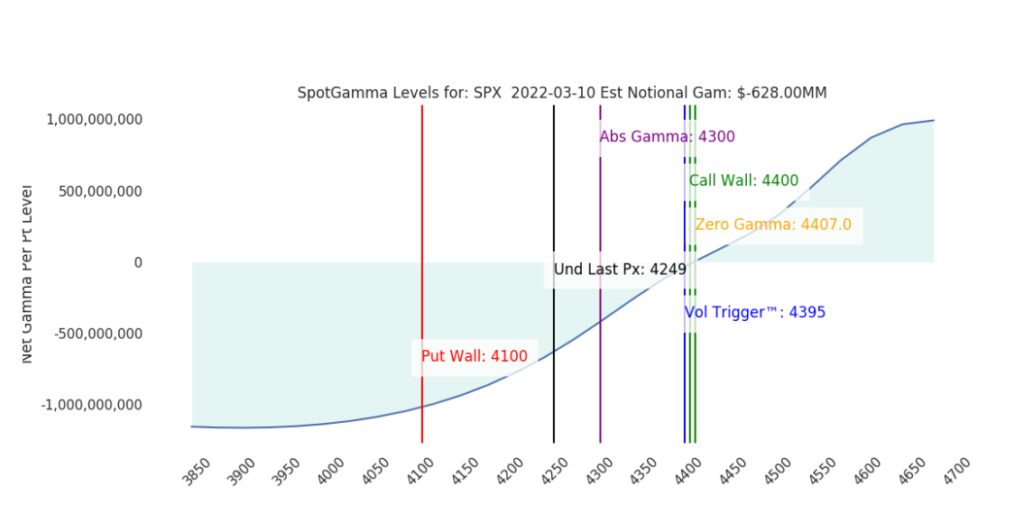

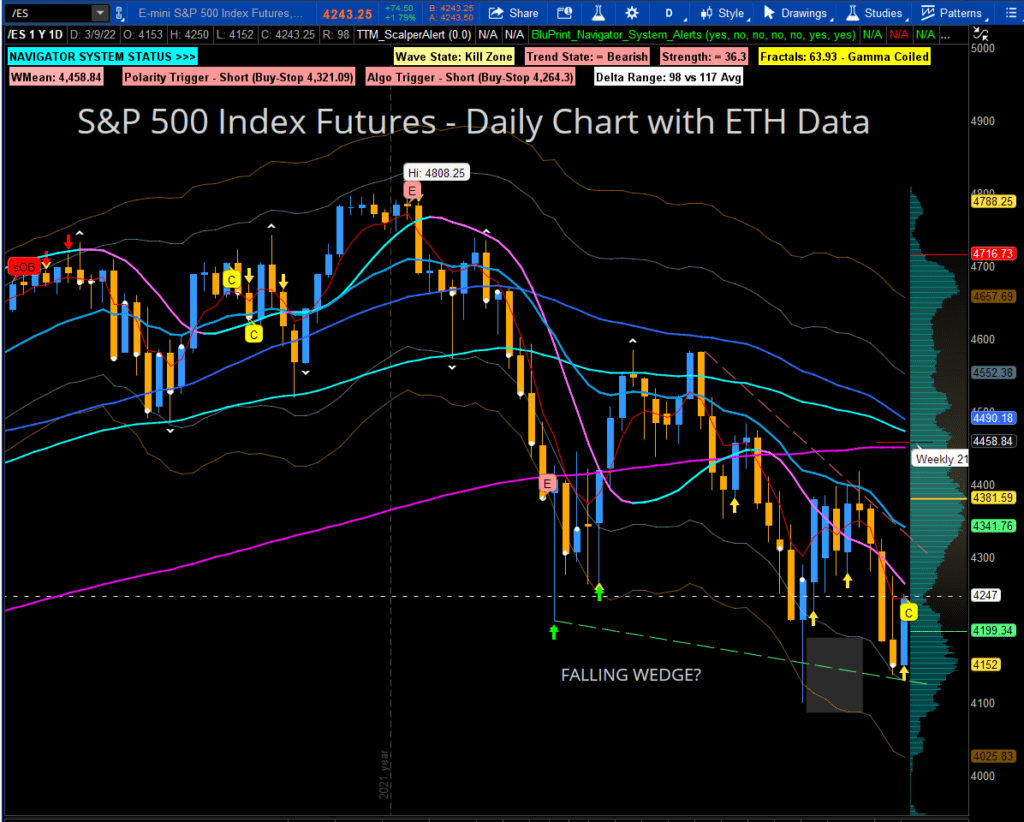

- My best judgment, and it is somewhat speculative, is that we will open at the 4300-4320 resistance area and pin in a tight trading range. As you can see from the chart below, 4300 stands out as an obstacle to higher prices at least through weekly expiration today.

- On the very optimistic side, I can calculate a gamma-adjusted volatility range of about 63 points up or down from the Open. If we open around 4300, that ranges between 4363 and 4237. But that is very optimistic.

- With the top of the Weekly, Expected Move up at 4453 – there is headroom for more gains today, but it would counter the falling wedge downtrend line on the daily chart, which might still be our best range guide at the moment.

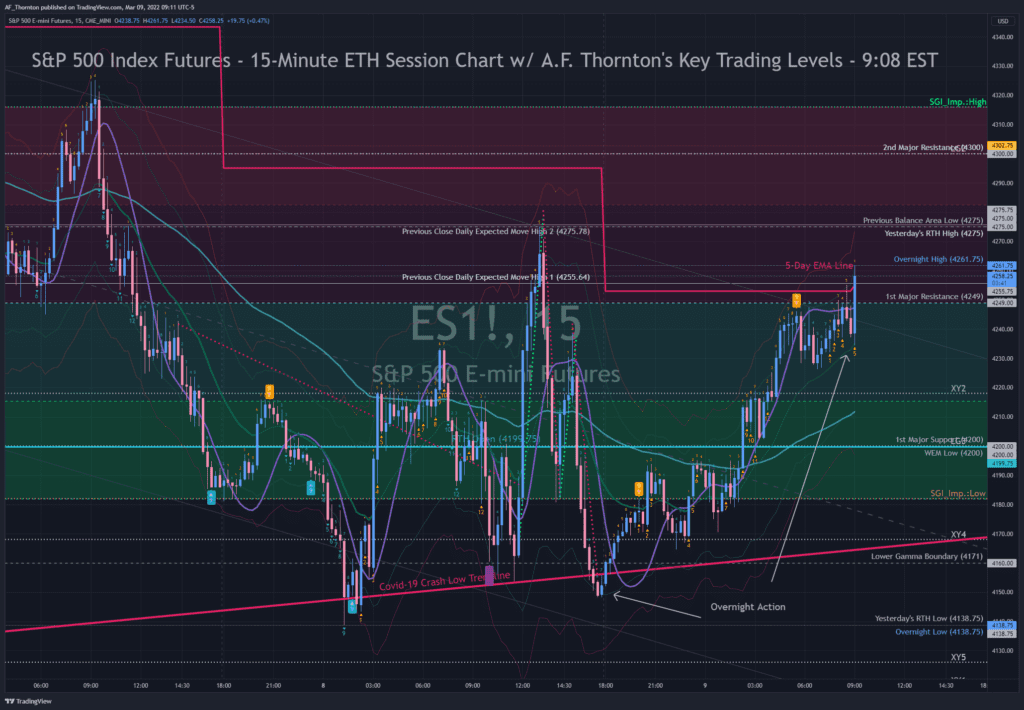

- Last night (which is the most accurate picture), the options market was pricing a 52 point move from yesterday’s close at 4257.25. That would give us a range between 4205 and 4310.

- So a lot depends on where the market opens. But there is considerable resistance at 4300 and 4320. The market is likely to pin there for the rest of the day.

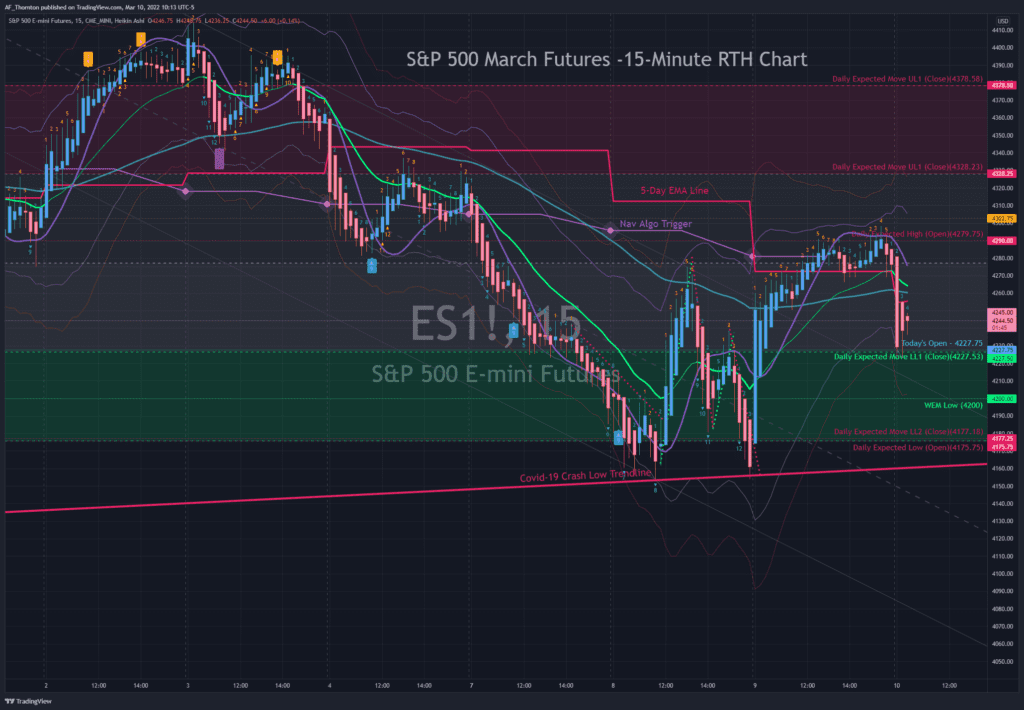

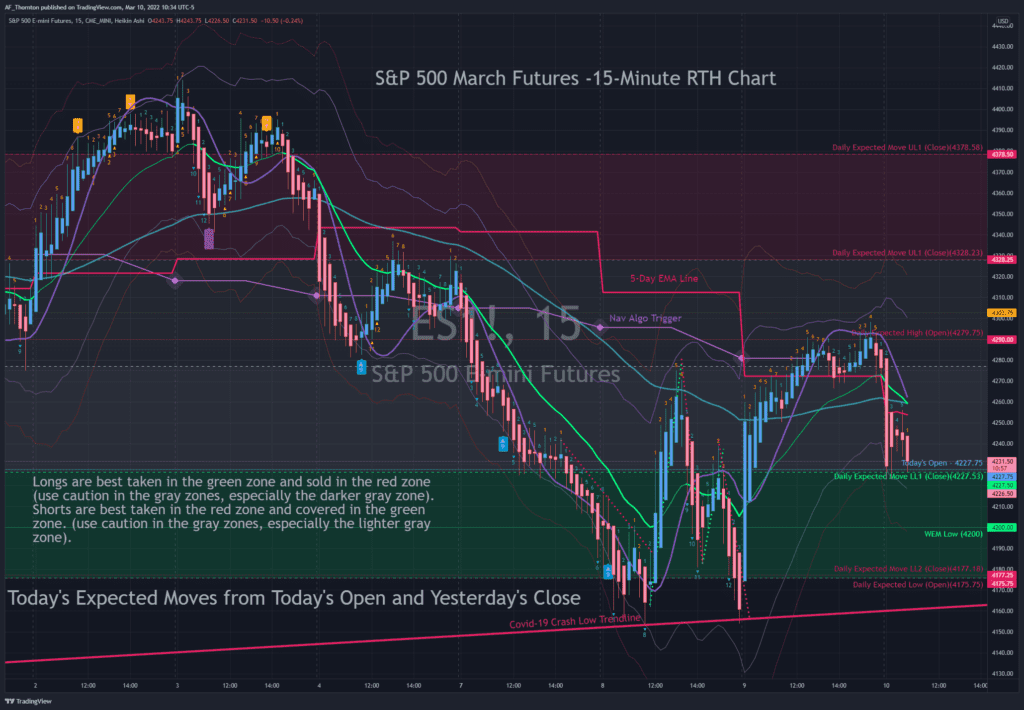

- I will mark the options pricing range from yesterday’s close on the quartile shading. Remember that we will open at the top of the range I would have projected without the Putin Pop.

- The idea is that you want to take longs in the first quartile of the projected range, which is light green. Traders should take shorts in the top quartile or light red end of the spectrum.

- In this kind of volatility, it is best to avoid taking positions in the middle of the range.

- I will update the weekly outlook over the weekend.

- Next week is the big Fed meeting.

- The market is ready to rally, and it could start before the meeting, but I still believe that monthly expiration a week from today has the potential to hold the market back.

- Lately, the rally starts on the Tuesday after expiration. We will have a better idea as we approach monthly expiration next Friday.

- I would view most rallies at this stage to be “short-covering.” They will be subject to fast reversals.

- Clarity on monetary policy and geopolitics will drive sustainable gains, but I suspect the significant positions expiring next week are Fed hedges.

- I will adjust all levels and repost once I have the Opening price.

- While a lot of the Putin Pop has retraced, the market will open with a True Gap, so Gap Rules apply this morning.

- If the gap fills easily, it would be bearish, and sellers are likely to return on acceptance within range. If the gap is not filled at all or only filled partially, that can be a long signal for further short covering.

Have a great weekend.

A.F. Thornton