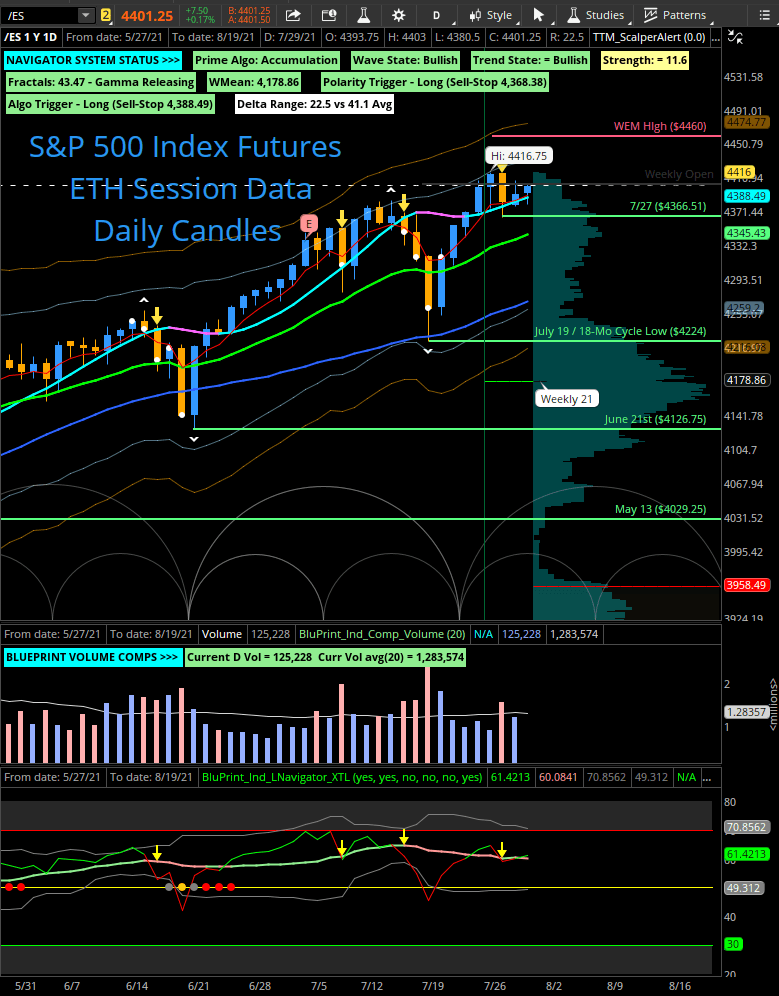

Overnight inventory is balanced, and we are currently trading inside yesterday’s range. The daily chart implications are an overall triangle balance area starting with the 7/27 (Tuesday) base between 4416.75 (now the all-time-high) and the low at 4364.75. Then we have yesterday’s (Wednesday) inside Fed range day balanced between 4407.75 and 4377.50. Now we have the overnight range inside both Tuesday and Wednesday’s range and bounded by 4403 and 4480.50.

So what we have is a classic three-day triangle into the GDP and employment reports this morning, which included the widely followed price deflator inflation gauge. That may be why yesterday’s Fed day finished smack in the middle of the range and ended up as a yawner of sorts. With the market still inside this range at this writing, we can take Monday’s approximate 50 point range triangle base and roughly project it from the middle of the triangle.

On a break to the upside, we get to a minimum target of 4440, and perhaps eventually to our 4460 Weekly Expected Move high by tomorrow. On the downside, we visit a target of 4340, right below the Weekly Expected Move low at 4346 and close to the 21-day line and mean trading this morning at 4345.

Triangles generally are continuation patterns, so the upside is more likely than the downside. However, an upside break would also take us to the upper three ATR K-Band on the daily chart, an overbought extreme.

On the other side, visiting the 21-day line would not be out of the ordinary either and would complete a two-step corrective pattern off the last rally on the daily chart. But there are other potentially negative chart implications of visiting the 21-day line today or tomorrow to leave for another (hopefully unnecessary) discussion.

I will mention the potential expanding triangle topping pattern that began to form from a 7/2 daily base candle. I don’t think the pattern is legitimate, with an 18-month cycle trough in the middle of it, but I will mention it as a potential carry forward in your narrative. A negative break in the current three-day triangle would force my stops on the Navigator swing trades, a disappointment, to be sure.

Both the GDP and Initial Jobless Claims numbers missed their estimates this morning. That may be good news on the inflation front but less than good news on the economic front. The GDP number missed significantly, coming in at 6.5% versus an estimate of 8.4%. The jobless claims came in at 400,000 versus consensus estimates of 384,000. Continuing claims also are higher than expected at 3.269 million versus consensus estimates of 3.183 million. The GDP deflator came in higher than expected as well at 6% versus estimates of 5.4%. So inflation remains high, but perhaps slowing growth will tame it as predicted by the recent fall in 10-year treasury yields.

At this writing, none of this has managed to move us out of the overnight range, though we are trading in the upper third of the range and near the top. That still gives us no clues about how to trade the open, so it is better to get some price action under our belts before taking positions.

Keep in mind that the weekly open, defining a red or green candle for the week, is 4400.50. That will make the open an important level today. Also, tomorrow is the last trading day of July. The end of the month always results in some window dressing by money managers and sometimes strange market behavior. But there is a positive bias associated with the last few days of the current month and the first few days of a new month.

The bottom line is that Monday’s low at 4364.75 is THE line in the sand. Taking out the ONH at 4403.25 or the ONL at 4380.25 starts the ball rolling in the commensurate direction, then yesterday’s high or low, followed by Monday’s high or low and so on.

I will be using yesterday’s RTH high at 4707.75 as my threshold to look for long trades. As an abundance of caution, I will watch the middle of the range and yesterday’s settlement at 4391.50 as a threshold for weakness to begin presenting for shorts. Whatever the ensuing direction, monitor for continuation.

Good luck today.

A.F. Thornton