No complaints, the market looks fine going into lunch. Internals have remained strong, with 3 to 1 and 2 to 1 advancers over decliners in the NYSE and NASDAQ, respectively. Tick distribution has been mostly positive all morning. The S&P 500 has, indeed, broken to new all-time highs though I would not say it has set the world on fire, and I would like to see the break become more definitive in the afternoon drive.

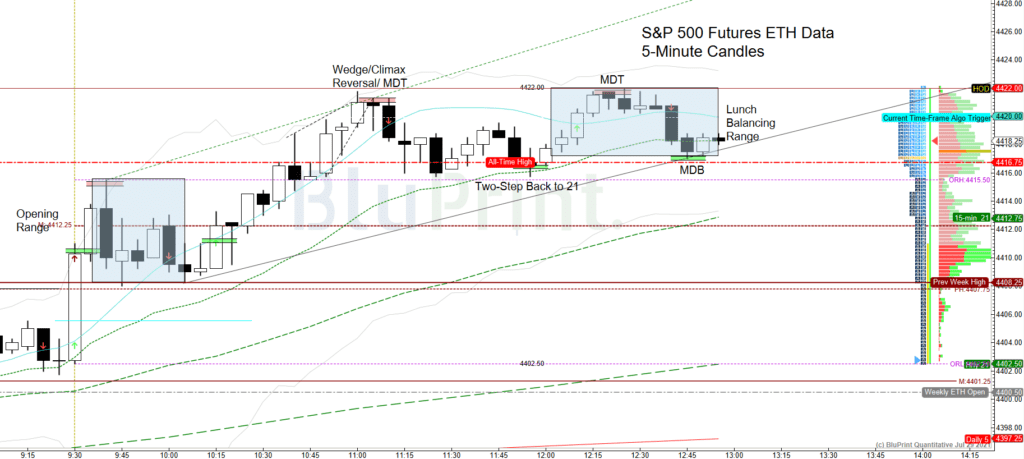

We started with a bull microchannel on our five-minute day-trading chart, followed by a common two-step correction back to the 21-period line. That now gives us a lower trendline for the remainder of the day. We have a short-term target of 4440, as mentioned in the Pre-Market Outlook. We may not get there today, as the market is already up quite a bit.

Our XLF and XLE swing trades lead the S&P 500 in relative performance as money continues to rotate back to these areas after three months of correction/consolidation. So far, so good, but my guard is always up.

Having passed the Fed meeting and quarterly GDP report, along with stellar earnings from many key stocks, the short-term bias remains bullish other than contending with the seasonal weakness ahead for August and September.

For now, It would take quite a reversal for July to finish as a red candle, so the trend continues as our friend until she dumps us.

A.F. Thornton