Morning Outlook – Update – 4/19/2021

Thus far today, we have put in a lower high and lower low on the daily chart, the first negative pivot since this last run started in early April. Add that to your narrative as negative.

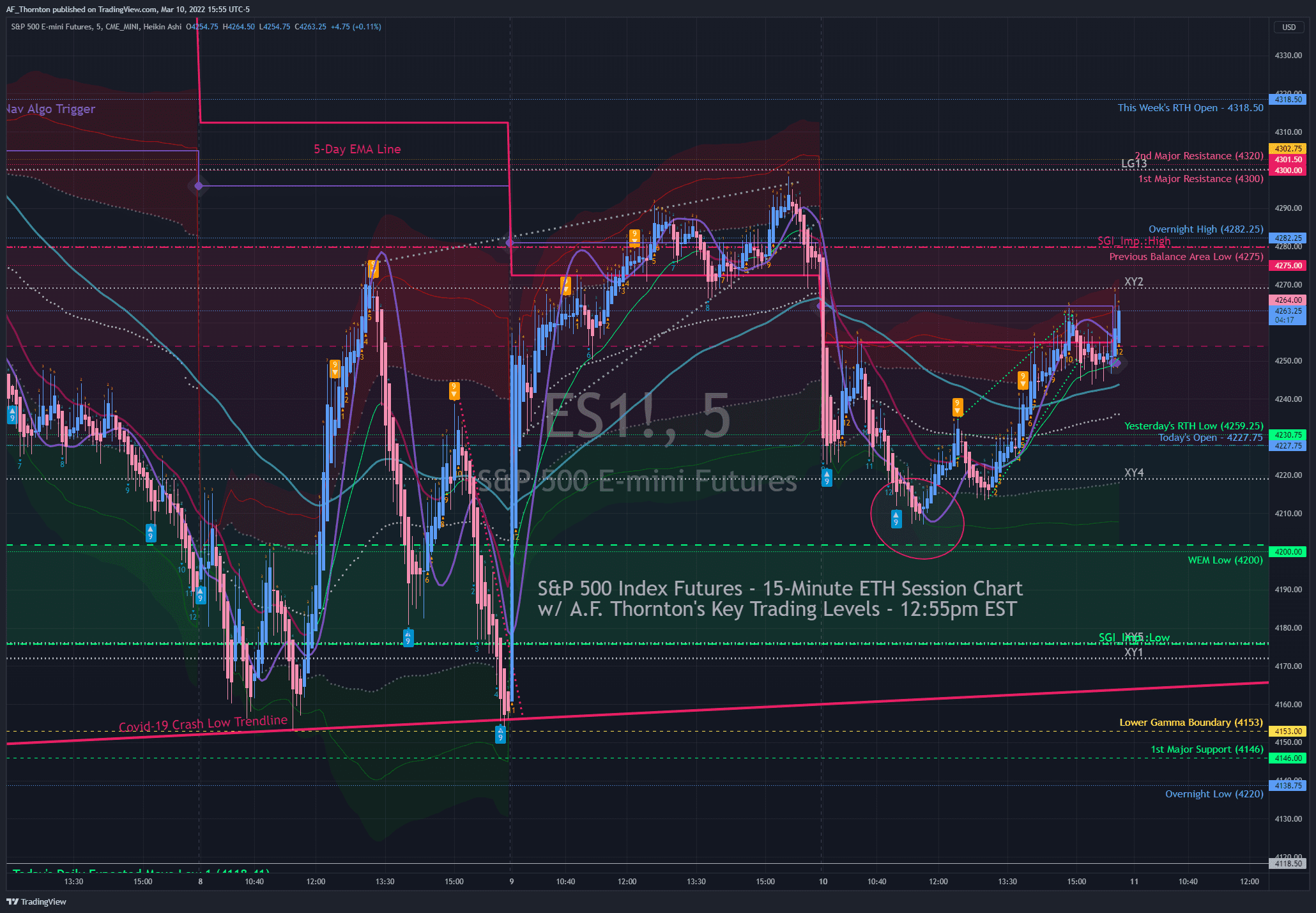

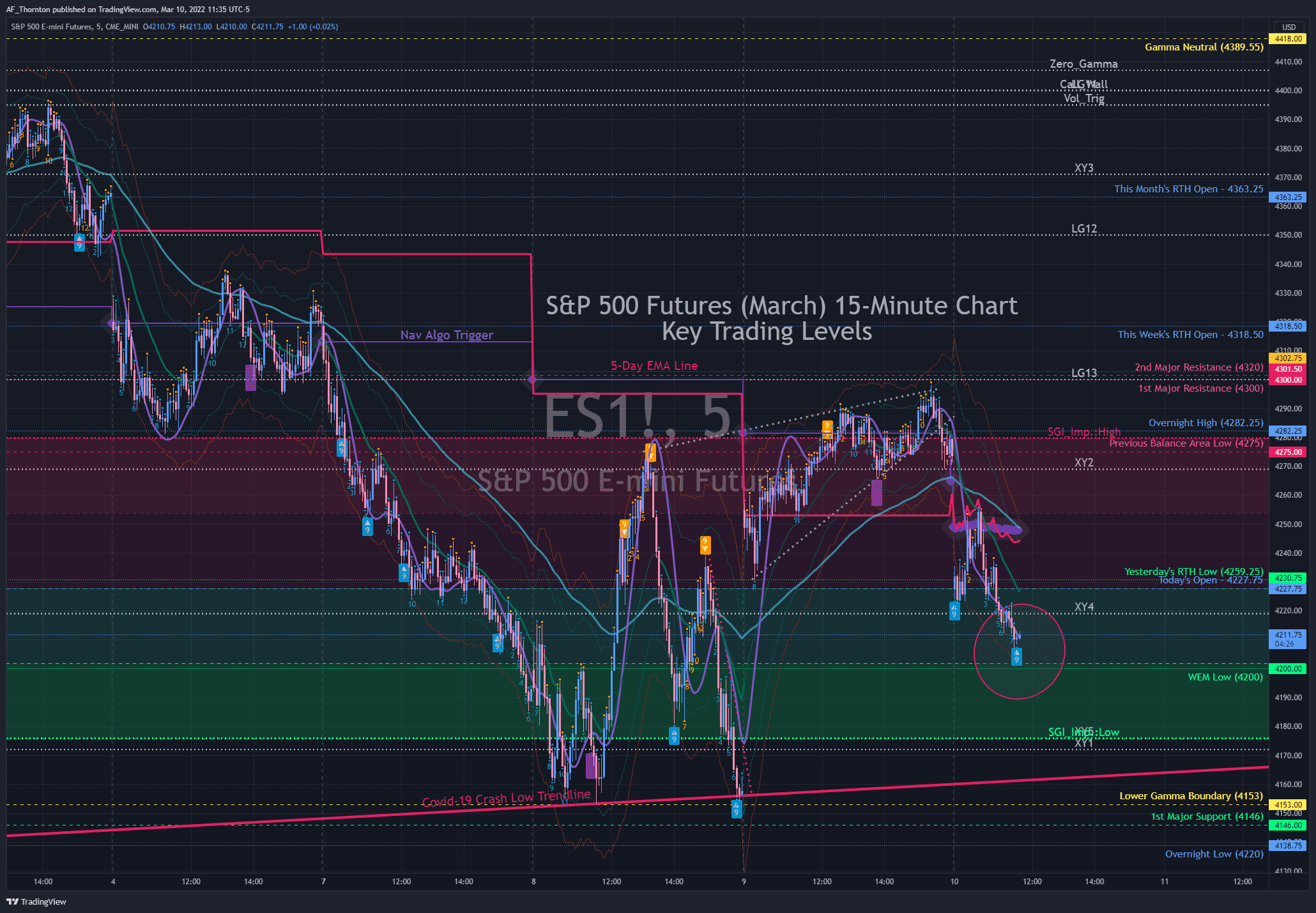

We are also tripping the Algo sell trigger, turning the daily candle red, as you can see if you click on the chart above. We also have solid Navigator sell signals independent of the Algo trigger (see red and yellow sell arrows). The polarity trigger is still holding, but I have to say that I am less than optimistic about its future. The trigger level for the polarity switch is 4127.41. The S&P 500 needs to close above 4151.76 to turn the Algo Trigger candle back to blue (blue encourages us to be long – orange is short).

The intraday chart looks like it is trying to wedge into a low. The price action is sloppy enough not to rule out another push down to Thursday’s low. That is where I will begin to cover my short positions for a nice gain. I should have done the shorts at the money – then I would be retired this morning. Oh well, I bank what I can.

This is exactly what I have been warning about – a day that starts clobbering through previous gains like a knife through butter. It is too early to conclude anything beyond what the Navigator system communicated so eloquently – the market is super overbought, and the institutions are not interested in buying here. That puts the market on borrowed time until the price hits a level that attracts them.

Whether this is the nominal 18-month cycle peak will take more price action and data to conclude with certainty. All we need to know for now is that it could be, and that gives us context to interpret the chart in front of us.

Perhaps more worrisome, the volume is picking up today – indicating that some institutions are participating – but they are selling, not buying. There is a slew of important earnings reports this week, and that may add to the confusion.

Maybe we should take the week off? Let it all sort out. It might be better to use options – stay with the bigger picture as I did over the weekend. Day trading could be treacherous in the current conditions. In either event, the winds are blowing south. Market leaders today are all defensive, underscoring a change in the weather.

Be careful!

A.F. Thornton

Related Posts