Dueling Banjos with Your Coffee

In our last episode (last night), I left you thinking that I would see what the Europeans wanted to do with these markets. They voted with their feet – exiting stage right and thanking the Asians for driving their exit prices a bit higher from the New York close. It is nice to score a couple of points against China.

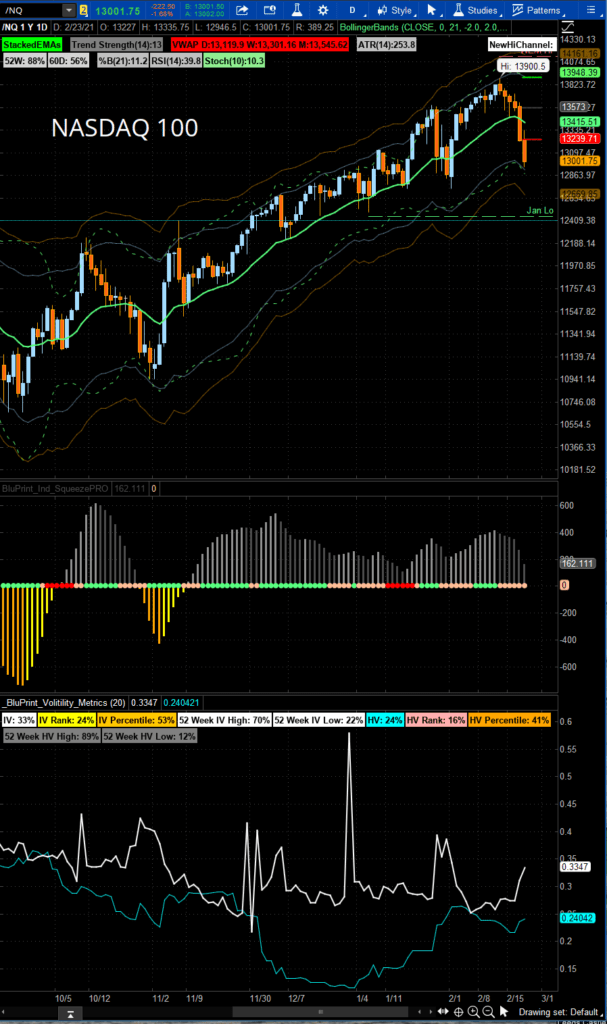

If the futures are to be the harbinger for the day, the NASDAQ 100 broke its 50-day line and its recent trendline last night. The NASDAQ 100 has also easily breached its Weekly Expected Move low, not a great sign for the market makers – who are largely responsible for selling futures this morning to neutralize their portfolio deltas.

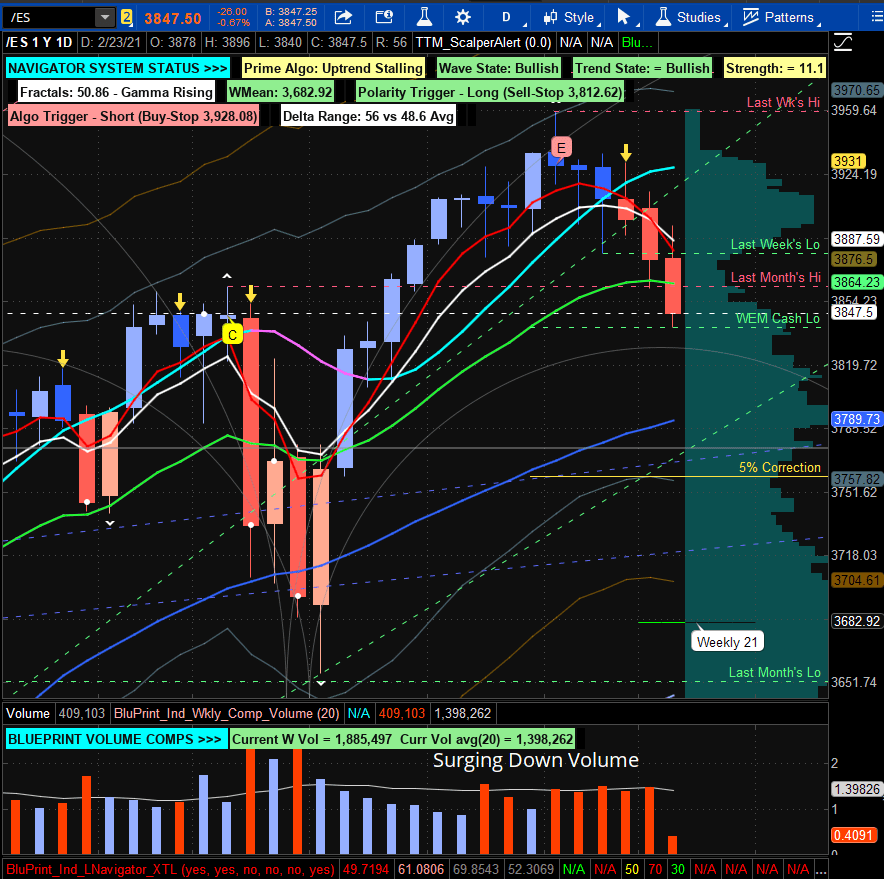

The S&P 500 futures are slicing through the mean at the 21-day line – following the NASDAQ 100 down this rocky road. The S&P 500 futures are now taking out last week’s low and moving into the January price range, more potential negatives. I am starting to think that this is the intermediate correction I had discussed last week and slated to bottom in mid-March.

Overall, I don’t think the S&P 500 really wants to be in this correction. The energy and financial sectors still want to rally. But technology is 30% of the index. While the financial sector will benefit from the steepening yield curve up to a point, it is not so good for technology and growth stocks. In any event, this correction is still a mild one – with a 5% top to bottom line correction still well below us at 3750. That would not be much to complain about – given the gains leading up to it.

The technology sector was all well and good when the seven FANGMAN stocks carried the entire market on its back (constituting 40% of the entire 500 stock index at its peak). But now, we are rolling the tape backward. The S&P 500 really doesn’t want to sell off and has much stronger underpinnings. But we cannot have it both ways now, can we?

And then there is the concept of throwing a match on gasoline. It won’t take a lot to get the crowd to panic here. So the S&P 500 index will only tolerate so much bifurcation. The financials are the key to everything right now, and I will be watching the XLF closely.

So the market is serving dueling banjos with your coffee this morning. Financials are still trying to carry us north, with the energy sector as its caboose. Technology wants to take us south. Who will win this battle? Only time will tell. Know this. I would rather watch than participate, at least for the moment.

The Navigator algorithms remain 100% cash. If you want to day trade the market today, gap rules are in play this morning, once again. Be careful with any early attempt at a fill.

With the large point divergence between the futures and cash this morning, moves are harder to predict. Let the gap rules be your guide with the emphasis on two and four.

If there is counter-trend rally action, monitor closely for the continuation and target the full gap fill at yesterday’s low. Take it step-by-step from there on any further strength.

Any gap and go continuation scenario will be coupled with extremely bearish internals and a partial to no gap fill in early trade. I can’t stress enough (like yesterday) that this is a hard play to pull off early as the market’s natural tendency is to take care of old business first, which is to deal with the overnight shorts in the gap.

Stay tuned…

A.F. Thornton

Related Posts