Afternoon Notes – 3/7/2022

- Another day passes in post-apocalyptic America – and it keeps getting stranger. Wake me up when it is over.

- So many things that make you go hmmm…

- The Biden Regime still wants oil from Terrorists instead of Texans. Yes, oil from Iran, Venezuela, and Russia. That should empower these unfriendly regimes at $130 per barrel.

- Wait, isn’t that what empowered Russia in the first place? Nice feedback loop!

- And then there is the Iran nuclear deal redux. Russia is mediating it. If you can get past that fact alone, here is the top Russian negotiator bragging about how China, Russia, and Iran snookered the U.S. The interview is scary.

- Russia receives all enriched Uranium from Iran’s nuclear programs in the new deal. Under the new “President Trump” provision, if a future U.S. President nixes the agreement again, Russia can return the enriched uranium to Iran for a bomb.

- Three of the Biden Regime’s negotiators have walked out on the deal. It is terrible – but Biden is moving forward anyway. Billions returned to the terrorists again. Will they need another 747 Jumbo Jet of cash? Come on; you know that the pilots grabbed a few handfuls.

- Thank heaven for the trustworthy and reliable Russians – so helpful!

- And back to the stock market…

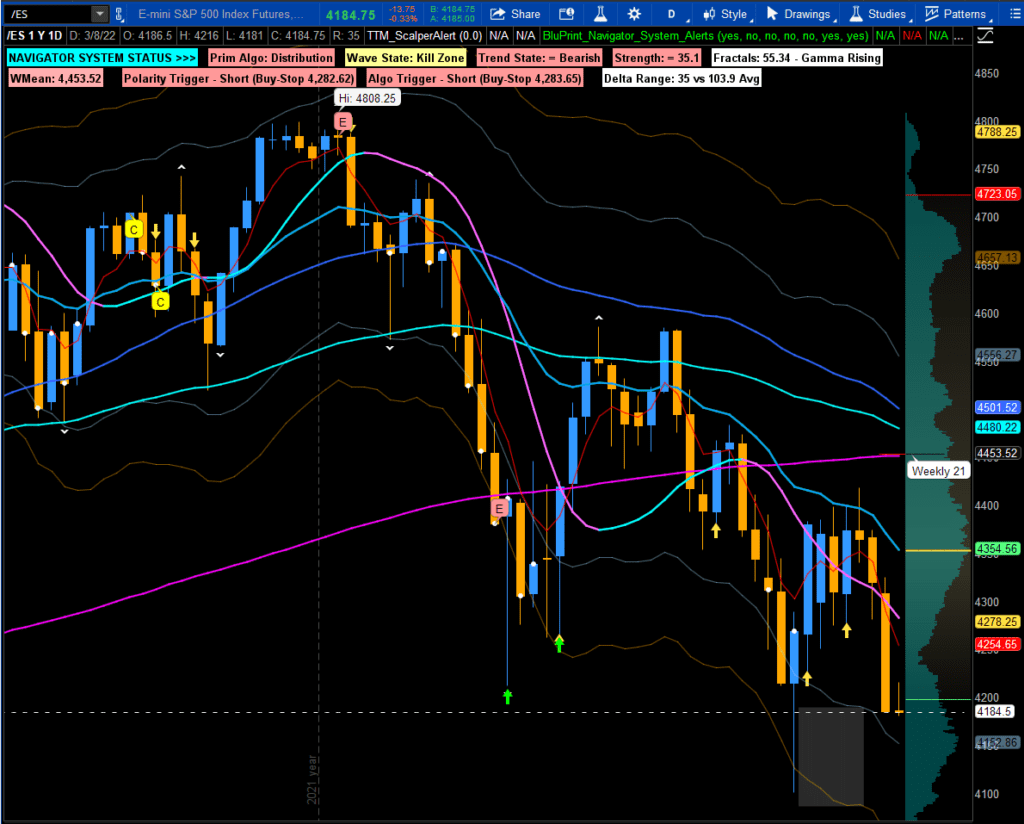

- The stock market continues to look ill with the war on COVID, war on inequality, the war in Ukraine: oil price spike, military-sanctions escalation cycle, etc.

- Financial market accidents threaten global recession, but it is still too early to position for the Fed/ECB pivot and QE5.

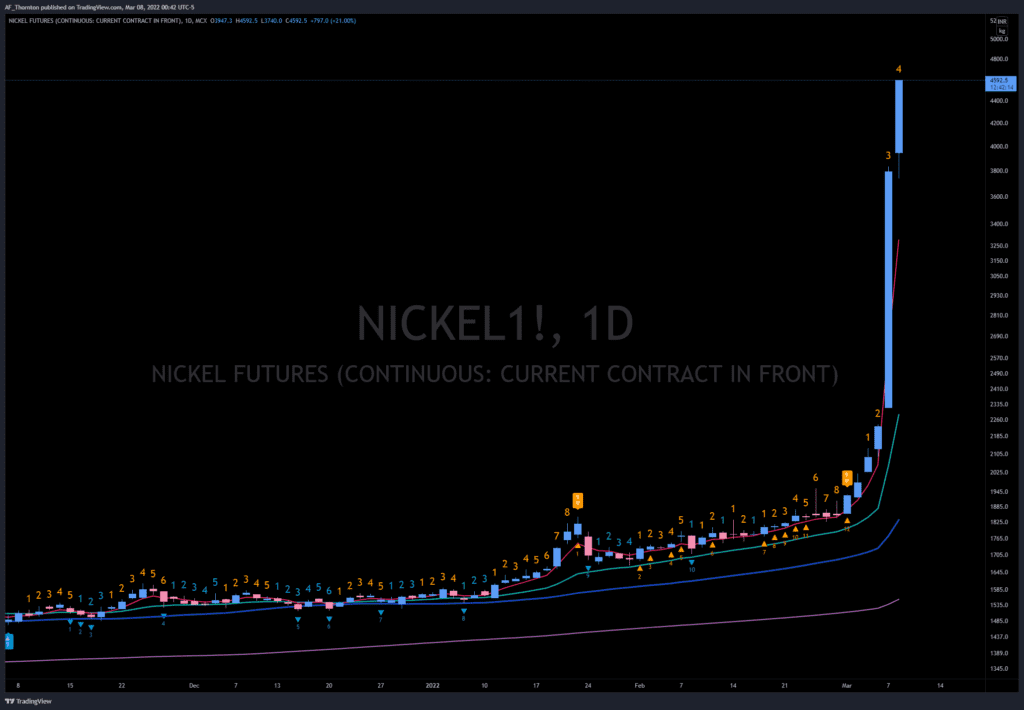

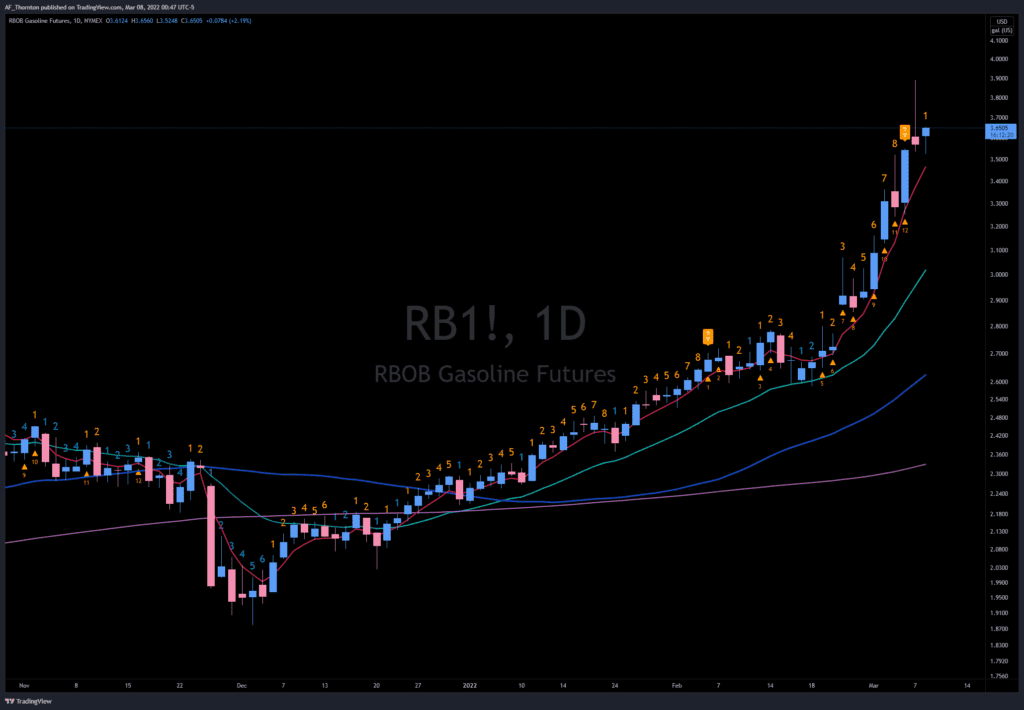

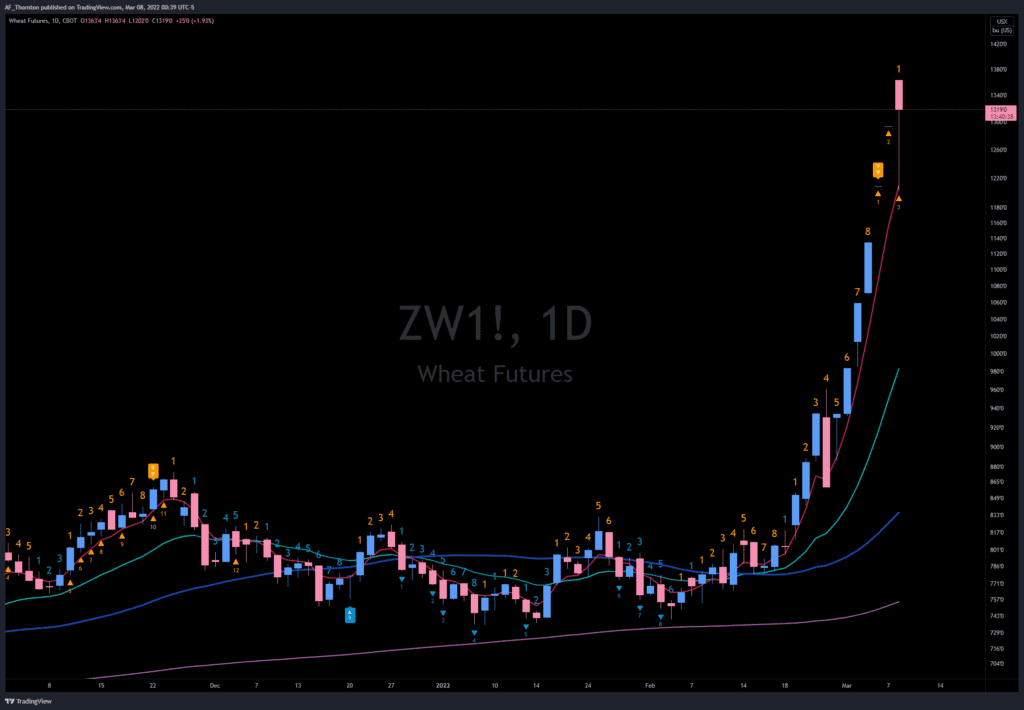

- Almost every industrial metal has the same parabolic chart as oil and wheat. Wheat has been locked limit up for so long that it barely trades.

- A nickel for your thoughts, anyone?

- Have you been to the gas station lately? Houston, we have a problem…

- Perhaps you can see now why it was such a brutal day on Wall Street.

- But Subscribers who followed this morning’s plan should be donning a big smile this afternoon.

- The Founder’s Group covered half of the short position at the ONL (4239) and the other half at 4200. There wasn’t enough runway left today to take another position. We considered a long position at the 4200 level, but the market looked too sick.

- The most significant event today was the S&P 500 index closing below 4211. The level goes back a long way, and the violation is a bad omen. We also closed below that Put Wall and WEM low. I cautioned about that in the late morning update. Too much further, and Dealers will have to sell even more index futures to hedge their Friday expiration risk.

- The largest concentration of options open interest is at 4000. The level should help catch the downward spiral.

- My first target at 3600-3700 is where I expected a bounce before traveling to the middle of the long-term channel at 2500.

- All of this could take a while – six months to a year.

- Options Guru Brent Kochuba is calling this “Controlled Demolition.”Due to the inflation spikes and the upcoming Fed policy change anticipated for mid-March, the street was already hedged at the invasion. So few were caught with their pants down, as they would typically be when Russia invaded Ukraine.

- Instead of a crash or spike lows, the overly hedged street experiences a controlled Gamma spiral down, with a few loops up.

- Today was slow and frustrating – like watching the grass grow when we are used to quick rewards in our short positions.

- Don’t discount spikes or crashes yet. Something tells me that everyone cannot hedge against losses. Something might break when everyone runs for the exits at once.

- All those charts with spikes up represent broken markets. There will be more to come.

- The next few monthly inflation charts promise something to behold, but what can the Fed do? Higher interest rates won’t help the problem and promise to trigger the next recession – which is coming anyway.

In my next life, I want to be a dictator like Putin – perhaps more benevolent. Here is my investment strategy. Load up on gold and oil—short the stock market, especially my own (RTY down -90%).

Then invade my next-door neighbor and throw out a few nuke threats. Pump as much oil as possible. Sell the gold. Reverse the stock market short to long. Negotiate peace. Rinse repeat.

It promises to be an interesting night. It now takes a 7% move in Globex to lock limit the S&P 500 Index. Let’s hope we don’t face that any time soon.

I will update all Key Levels in the morning notes.

A.F. Thornton

Related Posts