Morning Notes – 3/15/2021

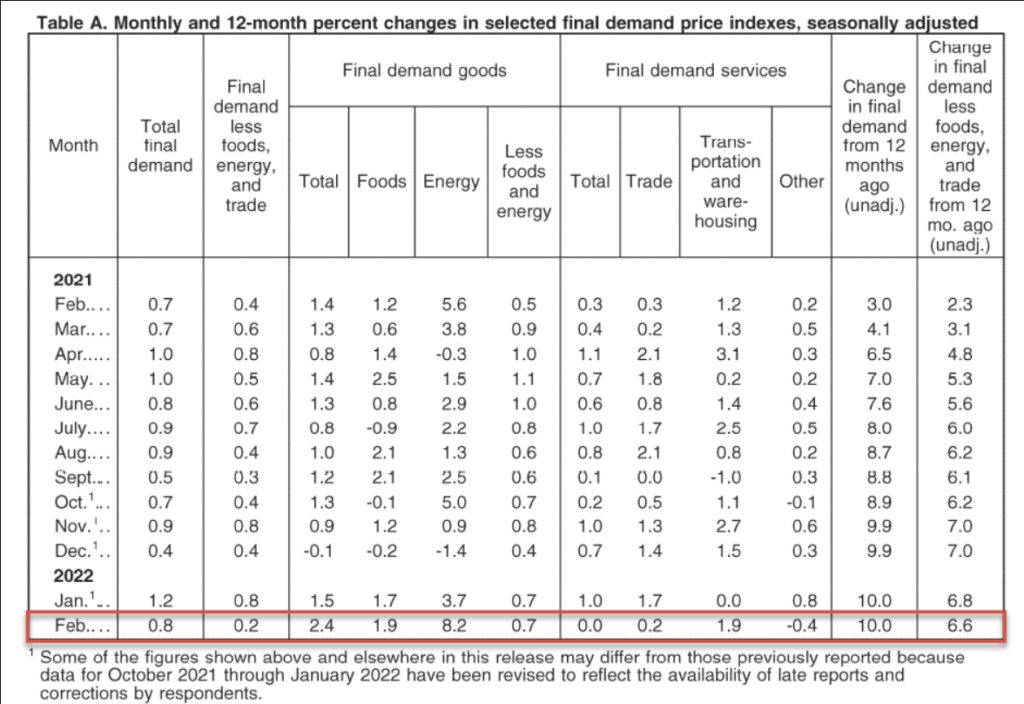

February Producer Prices +10%

Good Morning:

- I harken back to law school finals, which is the last time I recall pulling all-nighters. I now remember that I felt worse the second day than the first. I must avoid these in the future; I am getting too old and feel like I am experiencing a college hangover.

- As such, I will tackle charts later this morning, though nothing has changed much.

- The headlines have been writing themselves again lately: “When we’re having this discussion, it’s important to dispel some of those who say, well, it’s the government spending. No, it isn’t. The government spending is doing the exact reverse, reducing the national debt. It is not inflationary.” Nancy Pelosi

- Hey Nancy, Producer Prices rose 10% last month, you are not spending enough! Politicians and financial advisers are the only categories showing significant demand waning and lower prices.

- The NASDAQ 100 took out its February low yesterday, but the S&P 500 holds just above. From a NASDAQ perspective, it looks like a bear flag to go lower, but the S&P 500 is hanging on to a falling wedge look. Even within the wedge, there could be lower prices.

- There is no shift in the outlook. The sentiment is poised – maybe even screaming – for a rally. Fed announcements come tomorrow. Options and Futures expire Friday (Quadruple Witching), with almost one-third of outstanding options expiring.

- And don’t forget about short-covering rallies. If it were not for those, this would be no fun at all.

- Significant support today will be at 4151 and 4126. Resistance is at 4201 and 4250. For now, that is your chart for today.

- Hedge Funds have been taking profits on commodity spikes, with oil poking back down below $100 last night. Buy the dip?

- We would open with a small gap higher into yesterday’s range at this writing. It would not be a True Gap, so Gap Rules are not applicable.

The NASDAQ 100 continued to explore new lows in overnight trade before returning into yesterday’s range. The NASDAQ behavior is classic h pattern price action, which allows for a bullish outcome.

The overnight rejection of lower prices and other technicals show potential for short covering in today’s session.

The S&P 500 continued to hold above the 2/24 low, but it looks like traders ran the stops under the 3/8 low before bringing the index back into yesterday’s range.

Markets added some more macro concerns yesterday, with Coronavirus headlines re-appearing and China imploding economically.

- 4000 continues to be the monster strike level, guarding the gates of market hell.

A.F. Thornton

Related Posts