Onward and Upward?

Good Morning:

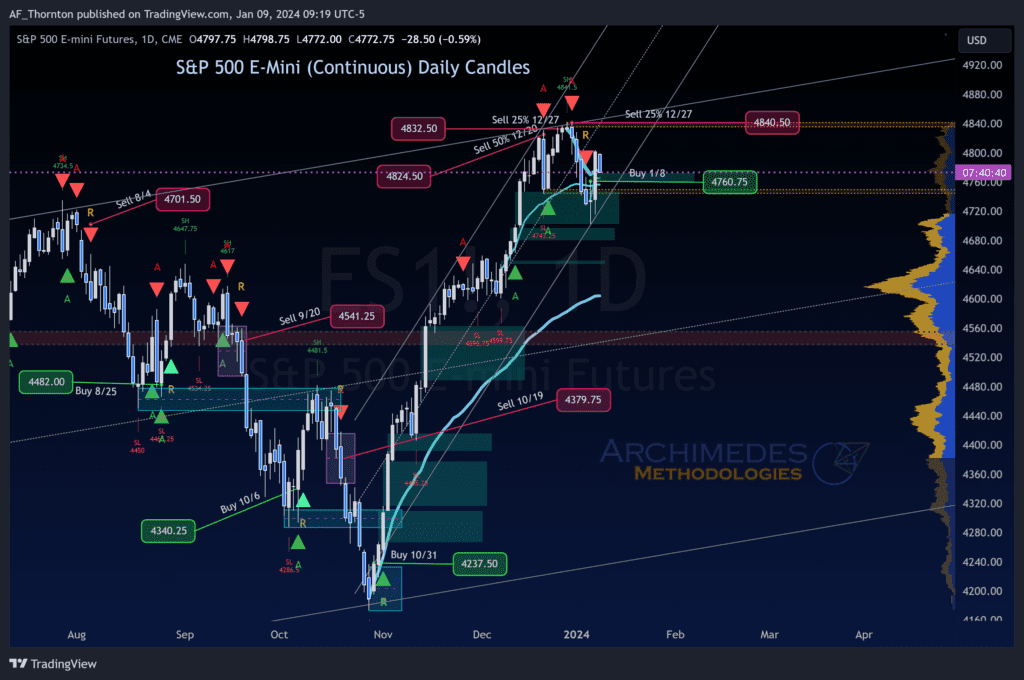

Happy belated New Year to all. I have, unfortunately, been laid up with a bad virus for three weeks. Believe me, headaches and cold medicine are not conducive to screentime. No complaints, however, as I rarely catch anything. Still, I thought I would come up for air to announce our first buy signal of 2024 which occurred simultaneously yesterday in our Daily and Hourly Strategies on the S&P 500 Continuous Futures Contract (ES or E-Mini) at 4760.75, SPY ETF at 470.50, and on the S&P 500 Cash Index at 4721.75 yesterday.

Our stop will be hourly closes below the five-day EMA on each of these indexes/instruments or at worst, breakeven. As far as the market moved up yesterday, all stops should be set to break even at a minimum. We came into the year in cash, having sold the last 25% of our October 2023 buy at ES 4840.50, SPY 476.75, and SPX 4788.25 on 12/27.

We are currently auditing our spectacular 2023 results. We will post them shortly in one chart, along with the Master Forecast for 2024. Recall that the 2023 Master Forecast was posted around the same time last year. Did anyone (including me) believe it? I seriously doubt it. The Gann mass pressure forecast seemed way too optimistic. Yet in the final analysis, the Master Cycle had an 85% correlation to the final results for the year, which the forecast under-projected! I will spend the rest of the week catching up and publishing last year’s results, as well as this year’s forecast.

So far, this decade is tracking two Gann cycles of interest. First, is the correlation to the 1960s. At one point, W.D. Gann called the 60-year lag his master cycle. He also thought the 20-year and 100-year lag to be relevant. So that would have us creating a composite cycle of 1924, 1964, and 2014. According to the forecast, major trouble for stocks does not show up again until late 2024 or early 2025. Nobody believed that last year at this time, so I am not surprised if nobody believes it now. But the Master Cycle proved them wrong in 2023 as it will again this year.

Lately, some astute forecasters have discussed the recent Turkish and Argentine stock markets, and how they have performed in the hyperinflation these two countries have been experiencing. How about tripling the gains of our stock market? If you fear inflation, the stock market could be a good place to hide. However, as one of the first to forecast the inflation we have experienced in the past few years, let me also be one of the first to forecast some deflation which could be challenging for stocks on the road ahead.

Notably, this is a Presidential Election year and the Uni-Party will grease the skids as much as possible. Also, the 18.6-year real estate and economic cycle isn’t slated to peak until early 2025. This cycle, first mentioned by Louise McWhorter and later W.D. Gann in the early 1900s, has been as reliable in Europe and then America as the Sun coming up for the past 500 years.

So sit back and enjoy the ride. Corrections and pullbacks usually have two legs down. The first leg is complete with yesterday’s turn. But yesterday was an unusual three-sigma move north, shooting to triple the Daily Expected Move and landing at the Expected Move High for the entire week on a Monday no less. Risk/Return probabilities are unfavorable from yesterday’s high, at least for the rest of the week.

And the market may take one more leg down before resuming the uptrend. A sideways / trading-range market would not surprise me either in the wake of the steep climb since last October. So stay vigilant. Extreme bullishness remains a negative, but supposedly there is a lot of cash on the sidelines waiting to deploy. I don’t put a lot of credence in what the Investment Banking community promotes, like supposedly high cash positions. In any event, investors always buy the first meaningful pullback in a steep uptrend. And like Turkey and Argentina, maybe we should be planning for a melt-up rather than a melt-down.

Our Hourly Strategy is suited for those with a short-term risk mentality but involves more trades and shorter holding periods. The Daily Strategy is better suited for intermediate swing traders who are comfortable with more fluctuation and prefer longer holding periods and fewer trades. Your choice.

Keep in mind that bank earnings come out this week, and the Consumer Price Index inflation report comes out on Wednesday. So there will be some additional volatility associated with those events.

Again, Happy New Year! This election year promises to be one of the most pivotal moments in our Country’s history. It may be a good time to keep a journal for your descendants. History is often a lie recorded by liars. Would that surprise you?

Don’t forget to move stops to break-even!

A.F. Thornton

Related Posts