Party On…

Navigator Algorithms – 100% Invested

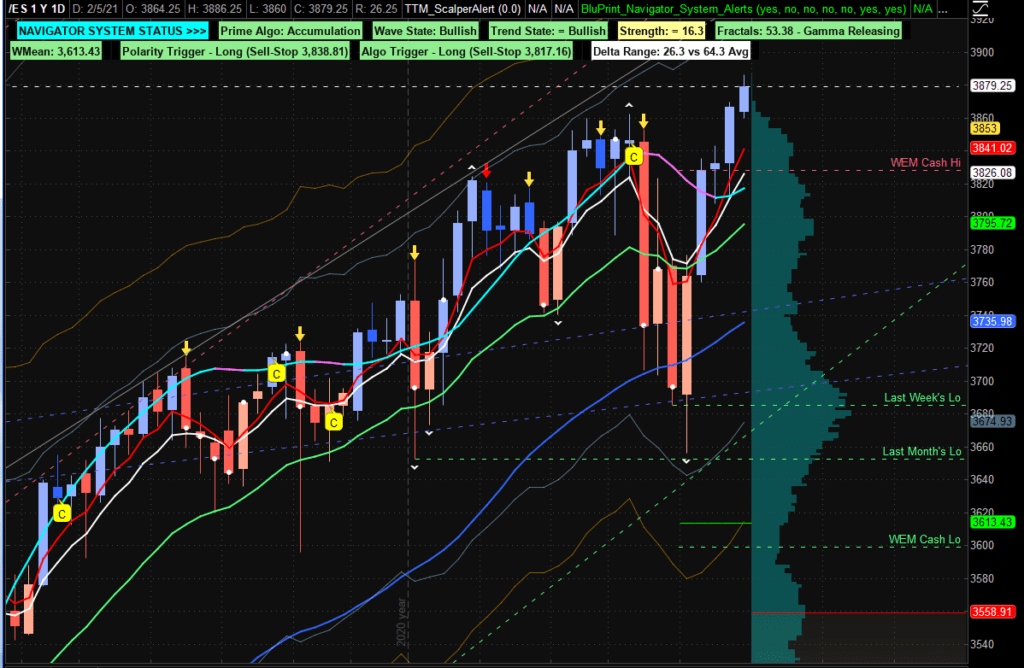

Yesterday, the Nasdaq 100 and S&P 500 indexes hit new all-time highs, with the S&P 500 index perhaps on its way to that final 3900-4000 target I set last November when we broke out of the consolidation. Given the double-wide volatility swath set by the options market makers this week, this is a truly amazing feat. Keep in mind that the S&P 500 futures tagged 3650 only last Sunday night. At 3881, this writing underscores concerns that the market continues in an irrationally exuberant, blow-off stage.

Today, with the S&P 500 index having blown through the options Weekly Expected Move (WEM) high at 3830 yesterday, the gains could accelerate as the options market makers race to neutralize their deltas before the close. Recall that the options market makers blew the WEM low last week, with the market closing well-below the level set for last Friday’s expiration.

I need to do a primer on the WEM to explain this to everyone better, but the influence of weekly options expirations on the markets cannot be understated. When the market escapes the range set for options each week, one needs to be extra vigilant in the attendant volatility. Billions of dollars in losses are at stake when these weekly levels and ranges are exceeded before the Friday close.

Of course, today is far from over, though the futures are net-long overnight. Market makers may attempt to drive the market back towards the 3830 expiration before the close to minimize their losses. I intend to issue a sell signal at the open to grab some of our own gains today to help them out. Since 3850 acted as a barrier for a few weeks, the level might be retested today as traders adjust inventories before the weekend. A retest might also be a place to add to positions.

Stay tuned.

A.F. Thornton

Related Posts