Update

So far this morning, we have the Dow hitting a new, all-time high. The Russell 2000 Small Cap Index closely follows and is within hitting distance of a new, all-time high. The S&P 500 is running in third place, with at least 60 points to go. The NASDAQ 100 is miles behind, at least 1000 points off its all-time high.

Interest rates have backed off a little overnight, while oil is hitting 18-year resistance here. This is giving technology a small boost, as well as a few other growth stocks. Financial and energy stocks are taking a breather. One day, of course, is not a trend.

All of this equates to a striking index divergence – and not a typical healthy, syncopated, or correlated equity market. We have to give some allowance for the discrepancies because the cyclical/value sectors and the leading growth stocks are coming off a historic spread favoring growth. Allowing for some spread reversal is not unreasonable. Nevertheless, the behavior is a warning that this correction may continue south after this brief reprieve.

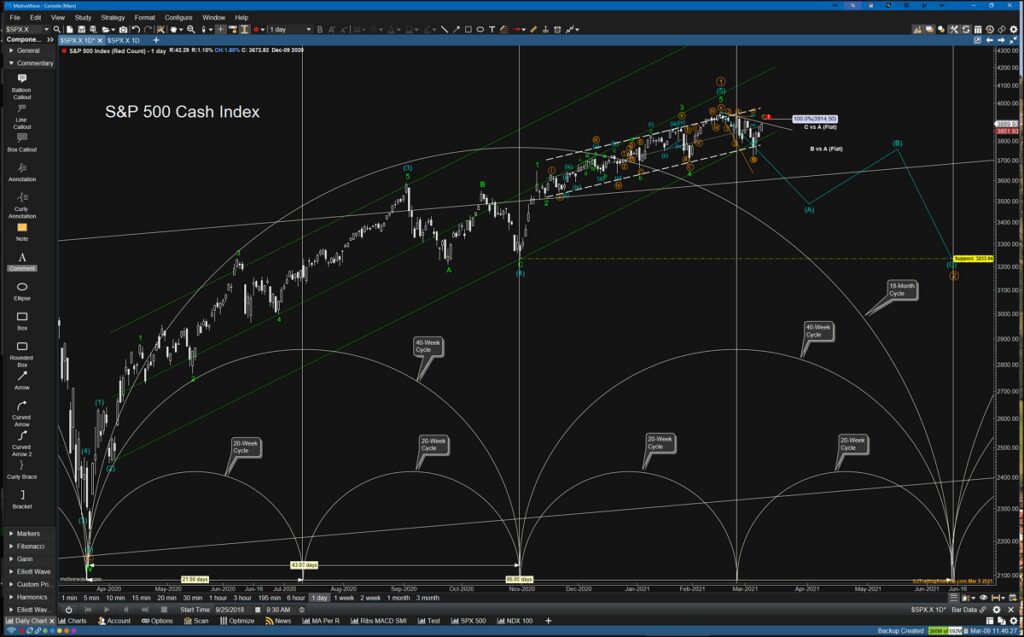

On cycles, keep in mind that the 20-week cycle could bottom (and likely already has), but the next 20-week loop may result in some indexes and sectors achieving new highs and some not. The cycle could roll over below all-time highs in some sectors – perhaps even in the Nasdaq 100 index itself. This sometimes happens in the fourth 20-week sequence that leads to the 18-month low. The chart below outlines the current road map.

[Clicking on the Image Below will Bring Up the Full Model]I would normally be issuing a buy signal by the end of the day. The algos are telegraphing the buy signal now, but the price would have to stay above or near current levels by the close to confirm the signal.

The problem is that the algos know how to buy and sell but cannot tell us how far the buy signal takes us. We have to do those forecasts with our other work. If the correction were to continue, then the buy signal would be hard-pressed to capture much gain.

Let’s see what the rest of the day brings, and if I think a buy is warranted for swing traders (meaning we can hold it more than a day), I will telegraph a signal about 15 minutes before the close. Otherwise, our swing trading model needs to stay in cash for now.

A.F. Thornton

Related Posts