Will 2023 Be The Promised Year from Hell?

Good Morning:

- We are coming into 2023 with a swing buy signal from 12/29/2023 at 3860 on the front month S&P 500 EMini futures contract, preceded by an hourly buy signal at 3828.

- Yet caution is warranted as the first trip back up to the daily chart mean at 3900 is usually sold.

- We must watch that area carefully, look to take some profits, and keep moving our stops up tight (a close five ticks below the 5-day line).

- And Gap Rules are on Deck this morning, as the Market is expected to Gap Higher at the Open.

- Support is below us at 3850 and 3815, with resistance at 3920 and 3980.

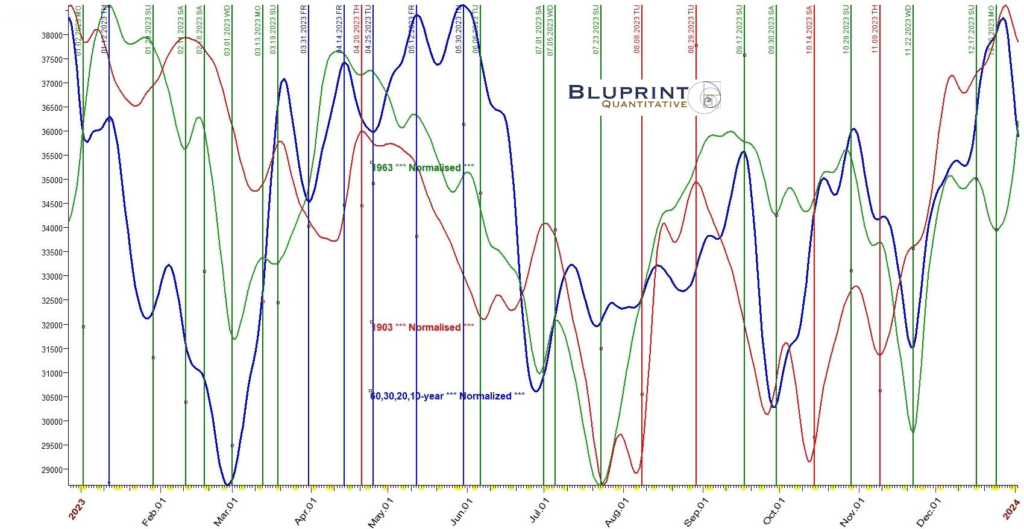

- As to the chart above, we look for turns indicated by the vertical lines, using our price action and algorithms to capture the turn if it manifests.

- Last year, the lines were accurate about 85% of the time, emphasizing the blue line and turns.

- This strategy will become clear when you review the 2023 outlook, which we will publish late today.

- All of the verticle lines indicate potential turns, but the blue line is the most probable path.

- Don’t marry the actual path and amplitude of the price, as it is less important than the turns/trend changes.

Welcome to 2023! The first day in the trading room will be Thursday.

A.F. Thornton

Related Posts